Personal Finance

Our evaluations and opinions are not influenced by our advertising relationships, but we may earn a commission from our partners’ links. This content is created by TIME Stamped, under TIME’s direction and produced in accordance with TIME’s editorial guidelines and overseen by TIME’s editorial staff. Learn more about it.

If you’ve made mistakes with your credit in the past, you’re in good company. Credit is a difficult thing to wield for many people. The sudden ability to spend above your means is a responsibility that isn’t for everyone.

Capital One believes in second chances, and it created the card_name to that end. This card is one of the easiest non-secured credit cards for which to be approved.

For those with a sub-600 credit score, this card gives you up to 5% cash back on purchases. The card even has a superpower of sorts that not many other credit-building cards offer. I’ll tell you about it, and give you a full tour of the card_name to help you decide if it’s right for you.

TIME's Take

The card_name is an alternative card. It’s not a card that you should choose if you’ve got a decent credit score, but it may be a necessity based on your current financial situation. The card’s value is hamstrung by its annual_fees annual fee, however — something that many competing cards don’t have.

Pros and Cons

PROS

- Easy to be approved.

- Up to six months of free Uber One membership.

- It’s possible to convert cash back into travel rewards.

CONS

- No welcome bonus.

- annual_fees annual fee.

- Return rate is lower than many competitors.

Who is the card for?

If you answer “yes” to the following two questions, the card_name could be the perfect card for you:

- You don’t have very good credit.

- You don’t have the cash reserves to submit a security deposit to a bank in order to open a secured credit card.

The card_name is for those who have either limited credit history or a only fair credit. Its earning rate is competitive with most other rewards credit cards targeted toward this demographic, but its benefits are unimaginative. It also incurs a annual_fees annual fee, which is high for a credit card that doesn’t offer much in return. That said, the card’s main draw is its willingness to approve those who simply want to build credit.

For those with long-term credit card goals that involve travel, this card is a surprisingly good choice. That’s because it’s possible to turn the cash-back you earn into Capital One miles. The catch is that you’ll need to also hold a specific credit card that requires a good credit score.

If your credit isn’t quite healthy enough to be approved for proper travel rewards credit cards, you can open this one and hoard cash back while you improve your credit score. Then, once you’re eligible to open a card like the card_name, you can convert that cash back into Capital One miles and potentially already have enough travel rewards for a free vacation.

Rewards structure

The card_name has a very straightforward earnings rate devoid of potentially confusing features like rotating bonus categories. You’ll get:

- 5% cash back when booking hotel stays and rental cars through Capital One Travel.

- 1.5% cash back for all other eligible purchases.

- A 1.5% return rate isn’t offensive, but it’s nothing to pen a letter to your mother about. However, by holding a Capital One miles-earning card alongside this one, you can convert your cash back into Capital One miles. You’ll receive 1 Capital One mile for every cent you transfer from the card_name to a card such as the card_name.

The reason this is a big deal is because it unlocks enormous potential for your rewards. With a bit of strategy, you could get $0.2 (or more) from Capital One miles — effectively doubling the card_name’s return rate. You can transfer Capital One miles to lots of useful airline and hotel partners, such as British Airways, Avianca, Wyndham, Turkish Airlines, and more.

For example, you can book a one-way domestic flight on United Airlines by transferring Capital One miles to United’s partner, Turkish Airlines. As long as your route takes place within the U.S., you’ll always pay the same price (even if you’re flying to Hawaii — though availability for those seats is extremely hard to find). Here are the prices:

- 7,500 Turkish miles one-way for economy.

- 12,500 Turkish miles one-way for business class.

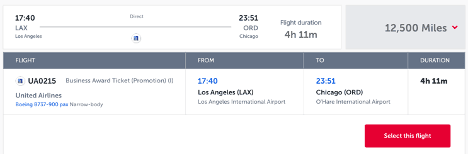

Depending on your route and cabin, you could get hugely outsized value for your Capital One miles. Below is the price of a business class flight between Los Angeles and Chicago. You’ll pay $560 one way.

(Screenshot courtesy of Google)

And here is the exact same business class seat when booked through Turkish Airlines. You’ll pay just 12,500 miles — giving you a value of 4.48 cents per mile — nearly 4.5x the value you’d receive from redeeming simple cash back.

In other words, if you were to use the rewards you accrue from the card_name in this way, the 1.5% return rate would effectively become 6.7%. That’s incredible.

(Screenshot courtesy of Turkish Airlines)

Capital One miles are also excellent for international flights. Partners include Avianca, Air Canada Aeroplan, Flying Blue (KLM and Air France), and others.

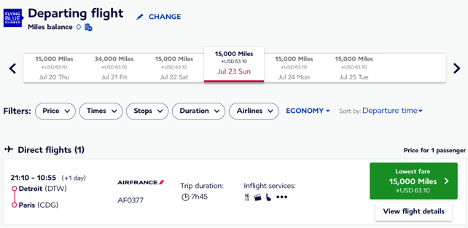

As another example, you can book flights to Europe (and even all the way to Israel) for as little as 15,000 miles one-way in economy on Air France. You’ll have to pay some taxes and fees (they can hover around $100 each way), but it’s well worth the money.

Below is a flight from Detroit to Paris. This ticket can easily cost over $700, meaning you can easily get a value over 4 cents per mile.

(Screenshot courtesy of Air France)

Additional hidden perks

This card has little in the way of ongoing benefits, as the main perk is the low bar for approval. Still, there are a few things worth mentioning with the card_name.

Free Uber One membership

This card confers a complementary Uber One membership of up to six months after you activate. The offer ends November 14, 2024.

Uber One regularly costs $9.99 per month — giving you around $60 in value. Uber One provides various Uber discounts such as unlimited $0 delivery fees on qualifying orders, 5% off eligible rides and a $5 credit when your Uber Eats food is delivered later than the stated “Latest Arrival” time.

No foreign transaction fees

Many cards charge you a fee (usually around 3%) when making a purchase that is processed outside the U.S. This will most often occur when you’re traveling abroad, but it can also happen when you buy something online from a foreign merchant.

The card_name waives this fee — meaning it’s a good companion when traveling.

Card lock

Capital One gives you the power to instantly lock your credit card to prevent it from being used in the event that the card is lost or stolen. You’ll find this feature inside the Capital One Mobile App, and it takes just a couple taps to complete.

What could be improved

Again, there isn’t a laundry list of benefits to celebrate with this card. It’s certainly respectable in key areas. For example, a 1.5% return rate is fair for a starter credit card.

The dagger that makes this card less than competitive is its annual_fees annual fee. Many of the best credit cards for beginners don’t charge an annual fee.

In short, this means that you’ll have to spend $2,600 in 1.5% cash back-earning purchases before you start to make a profit. Had you opened a similar credit card with no annual fee, you’d already have a healthy cash back bounty.

How does the card compare?

There are starter credit cards on the market that are far inferior to the card_name. Some cards targeted toward those with a low credit score don’t offer any rewards at all.

However, many of its competitors are far and away more lucrative — and they don’t charge an annual fee for the privilege of card membership.

For example, the no-annual-fee Bank of America Customized Cash Rewards Secured Credit Card offers 3% cash back in one of the following spending categories (which you can switch once per month):

- Dining.

- Gas.

- Online shopping.

- Travel.

- Drug stores.

- Home improvement and furnishing stores.

On top of that, you’ll earn 2% cash back at grocery stores and wholesale clubs. You’ll earn 1% back on everything else.

The only downside to this card is that your bonus cash back (anything over 1%) is limited to up to $2,500 in total spending per quarter. After that, you’ll earn 1% for all purchases. Still, the ability to earn between 2% and 3% for the vast majority of your spending is fantastic — especially for a secured credit card.

Here’s a digestible table to help you compare the card_name with other credit cards geared toward those with poor (or no) credit.

| Credit card | Return rate | Annual fee | Top features |

|---|---|---|---|

U.S. Bank Cash+ Visa Secured Card |

| $0 |

|

card_name |

| annual_fees |

|

U.S. Bank Altitude Go Visa Secured Card |

| $0 |

|

card_name |

| annual_fees |

|

The card_name brings a very humdrum offering to the table for those looking to build credit. If not for its annual_fees annual fee, the card would be significantly more competitive.

Its sibling, the card_name Secured Card, offers virtually identical benefits with no annual fee — but you’ll have to submit a deposit to the bank to open the card. If you’d prefer to pay an annual fee to avoid providing collateral to the bank, this card could be a fit for you.

Frequently asked questions (FAQs)

Is the card_name a good credit card to build credit?

The Capital One QuicksilverOne is helpful for those trying to build credit for one simple reason: It’s easy to get. If you’ve made some mistakes with credit in the past and are currently trying to foster your credit score back to a healthy number, this card is one that has more relaxed expectations for applicants.

What credit score do I need to be approved for the card_name?

If you’ve at least got fair credit (defined by FICO as 580), you should be eligible to open the Capital One QuicksilverOne. Still, credit score isn’t the only factor banks use in determining whether or not to approve you for a credit card. They may look at things like the number of cards you’ve opened recently, your current credit utilization, and more.

Is the card_name a secured credit card?

The Capital One QuicksilverOne is not a secured credit card. You do not have to submit a deposit to the bank to open this card.

What is the highest credit limit for card_name?

If you’re looking for a credit card with a larger credit line, you’re probably not going to get it with this card. It’s rare to be immediately approved for a credit line over $2,000. As you keep the card and are eligible for credit limit increases, however, it’s certainly possible to grow your credit line above that figure.

If you’ve got some money in your savings that you can float, you may do better by opening a secured credit card. Banks will extend to you a credit line that matches the security deposit you give to them upon opening your account. Many banks offer up to a $5,000 credit line for secured credit cards.

Is it hard to get approved for card_name?

It is not difficult to be approved for the card_name. As long as your credit score is at least 580, you qualify for the card (though, again, a qualifying credit score doesn’t ensure you’ll be approved).

How soon would I be eligible for a credit limit increase with card_name?

The card_name will automatically check to see if you qualify for a credit limit increase after six months of card membership. If Capital One perceives that you’re using your credit responsibly, you could receive a bump.

How can I upgrade card_namec?

Not all Capital One cardmembers are eligible to upgrade their cards. Capital One will tell you through your online account (or even via email and snail mail) if you qualify to upgrade your card to something else. Instructions will be on the offer as to how you can upgrade.

The information presented here is created by TIME Stamped and overseen by TIME editorial staff. To learn more, see our About Us page.

Featured Articles

Business Platinum Card from American Express Review 2025

Learn more about the American Express Business Platinum Card, its many benefits, and who it’s right for.

Chase Freedom Unlimited vs. Citi Double Cash Card: Why You'll Earn More with Freedom

Both cards are without an annual fee and feature generous rewards programs. But Freedom Unlimited provides a competitive edge with its cash back welcome bonus.

British Airways Visa Signature® Card Review 2024

The British Airways Visa Signature® card features a lucrative bonus and valuable benefits, but it’s not perfect for everyone. Learn more.