What Are I Bonds? All You Need To Know

Our evaluations and opinions are not influenced by our advertising relationships, but we may earn a commission from our partners’ links. This content is created by TIME Stamped, under TIME’s direction and produced in accordance with TIME’s editorial guidelines and overseen by TIME’s editorial staff. Learn more about it.

In periods of high inflation, earnings from traditional savings accounts and bonds typically fall short. Investors can take advantage of higher interest rates by investing in Series I Savings Bonds from the U.S. government. These bonds provide a guaranteed return based on inflation and income tax benefits. So what are Series I Bonds and why are they such a good investment during inflationary periods?

Series I Savings Bonds are commonly referred to as "I Bonds." These Federally-issued bonds protect investors and savers from the damages caused by inflation to their buying power. The interest rates for this type of bond are set twice a year based on the current inflation reading from the urban consumer price index (CPI-U) created by the U.S. Bureau of Labor Statics.

I Bonds are available for purchase digitally through TreasuryDirect.gov. Additionally, you can get a paper bond when buying them with your IRS Federal tax refund.

When you buy an I Bond, you receive the current interest rate set by the U.S. Treasury Department.

Your I Bond's interest rate is based on a combination of a fixed base interest rate plus the inflation rate. It is also known as the "composite rate" or the "earnings rate."

The fixed rate is a baseline interest rate that never changes for the life of your bond. It applies to all I Bonds issued during each six-month period.

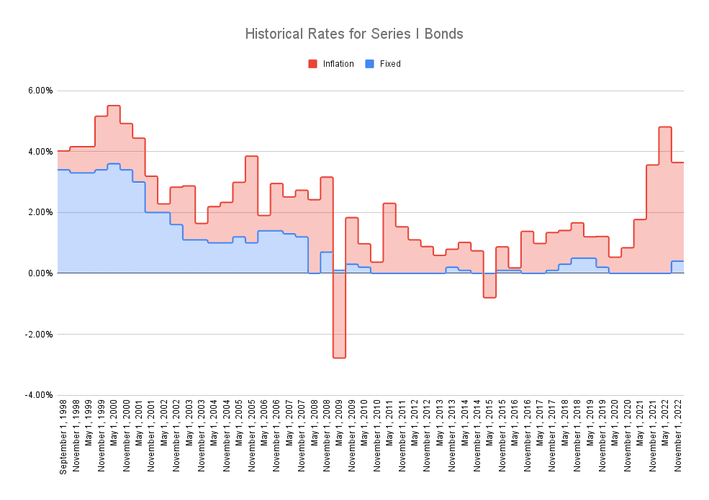

The inflation rate changes every six months. These rates are set twice a year – on May 1st and November 1st – based on the current inflation readings. The Treasury uses the non-seasonally adjusted CPI-U for all items, including food and energy, when setting the rates for Series I Bonds.

Series I Bonds earn interest for 30 years, which is the same length as a typical home mortgage. After the 30 years is up, they stop earning interest.

When your I Bond matures, consult with a financial advisor found about the best options to reinvest your money. You can be matched with a financial advisor in your local area and based on your financial needs through WiserAdvisor.

Find the right financial advisor with WiserAdvisor

Find the right financial advisor with WiserAdvisor

I Bonds earn interest on a monthly basis. However, the interest is compounded semi-annually. This means that the interest earned is added to the value of your bond every six months.

Although you earn interest monthly, I Bonds do not distribute interest income like savings accounts. The interest income remains with the bond until you cash out the bond.

Electronic (or digital) I Bonds automatically cash out when they mature after 30 years. The digital I Bond distributions are repaid into your linked bank account. However, you must physically submit a paper I Bond in order to cash it out.

If you don't want to wait until the bond matures, you can cash it out after 12 months. However, if you cash out your Series I Bond before five years, there is a penalty of three months of interest. For example, if you cash out your I Bond after two years, you'll only receive 21 months of interest.

Digital Series I Bond investors can find the value of their bonds by logging into their TreasuryDirect.gov account.

To calculate the value of your paper I Bonds and EE Bonds, the U.S. Treasury Department offers free online "Savings Bond Calculator" tools. At this site, you can calculate the present, historical, or future value. Additionally, you'll be able to find out current and past interest rates, the next accrual date, and its maturity date. The site also provides the year-to-date and total interest earned on this type of bond.

For readers that want to know how to calculate the value of their bonds by hand, use this formula:

Composite rate = [fixed rate + (2 x semiannual inflation rate) + (fixed rate x semiannual inflation rate)]

| Pros | Cons |

|---|---|

Interest rate adjusts every six months based on current inflation rates | Cannot redeem I Bonds during the first 12 months |

No State or Local income tax on interest earned | Three months interest penalty if cashed out during the first five years |

Purchase electronic I Bonds for as little as $25 | Federal income tax applies to interest earned |

Federal income taxes may be waived when used for qualified higher education expenses | Annual purchase limits per Social Security number or EIN |

These bonds are best for low-risk investors like retirees who want the value of their money to keep up with inflation yet earn more than a typical bank account, certificate of deposit (CD), or EE bonds. Although you can't redeem them during the first year, they are liquid for the remainder of the 30-year term. This liquidity is better than a CD while earning much higher interest rates.

Additionally, Series I Bonds are an excellent option for investors who can only invest in small amounts. With a minimum investment of $25 for a digital I Bond, these government-issued bonds are open to everyone. Additionally, you can buy a digital I Bond for any amount (up to $10,000), with amounts down to the penny. If you prefer a paper I Bond, you can buy them in $50, $100, $200, $500, or $1,000 increments.

The current rate for I Bonds is 6.89%. This rate is good for all Series I Bonds issued between November 1, 2022, and April 30, 2023.

This rate is a combination of the fixed rate of 0.40% and the semiannual (1/2 year) inflation rate of 3.24% (6.48% annualized).

New rates are announced on May 1st and November 1st of each year.

Investors can purchase I Bonds in two ways. Digital Series I Bonds are available at TreasuryDirect.gov. Paper Series I Bonds can be purchased through your Federal income tax return.

Interest earned from I Bonds is taxed on your Federal income tax returns. However, the interest is exempt from state and local income taxes.

Federal estate, gift, and excise taxes apply, as well as estate and inheritance taxes at the state level.

Investors can claim the annual interest on their tax returns each year, or wait until you receive the money from cashing out the bond. This flexibility makes it easier for investors to use tax planning to decide when to pay their taxes.

If distributions from your Series I Bonds are used for qualified higher education expenses, you may be able to exempt the earnings from taxes. Consult your tax advisor to determine if your situation qualifies.

Yes, you can buy up to $10,000 in electronic I Bonds and up to $5,000 paper I Bonds each year. The limit applies to each person's Social Security Number or EIN.

This means that a husband and wife can each buy up to the annual limits. They can also buy up to the annual limit for each of their children under the child's Social Security Number. Additionally, a business owner with an EIN can also buy up to the annual maximum in the name of their business.

With interest rates that can change every six months, buying an I Bond doesn't make sense for every investor. Here are some alternatives to I Bonds that you should consider before making an investment.

Series EE Bonds and I Bonds have many similar features. They share the same annual maximum purchase limits, tax treatment, redemption options, and 30-year duration. EE Bonds are a good investment when interest rates are high because they have a fixed interest rate for the first 20 years. The interest rate of Series I Bonds adjusts every six months, so they are an ideal investment when inflation remains high.

Yes, you can buy Series I Bonds as gifts for anyone, including children under 18 years old. To do so, you can set up a linked account for the child through your TreasuryDirect account.

When you cash out your I Bond, you'll receive a Form 1099-INT. This tax form comes from TreasuryDirect for digital bonds or the financial institution where you cashed out the paper bond. If you want to report your interest annually, you'll need to use the total from TreasuryDirect for electronic bonds or calculate the interest yourself for paper bonds.

Your I Bonds will never be worth less than you invested. The bond will increase in value every six months when interest earned is added to your account value. However, you will lose the last three months of interest if you cash out your I Bond during the first five years.

*Withdrawals before maturity date are subject to penalties.

The information presented here is created by TIME Stamped and overseen by TIME editorial staff. To learn more, see our About Us page.