What is a Mutual Fund Expense Ratio and What is a Good One?

Our evaluations and opinions are not influenced by our advertising relationships, but we may earn a commission from our partners’ links. This content is created by TIME Stamped, under TIME’s direction and produced in accordance with TIME’s editorial guidelines and overseen by TIME’s editorial staff. Learn more about it.

Imagine there was a foolproof investment strategy that could increase your investment performance by thousands of dollars over many years. Well, imagine no more. There is such a strategy, and the “secret” is expense ratios.

What are expense ratios? The short answer is that they are hidden fees contained within investment funds. And since so many Americans now invest using funds, expense ratios have become a mission-critical topic.

You don’t need to be an expert in expense ratios. But if you have a basic concept of what they are and what they can do, you can improve your investment performance — even dramatically — just by rearranging the funds you hold in your portfolio.

The expense ratio of a fund is the fund’s total annual operating expenses divided by its average net assets. For example, if the total annual expenses for a fund trading at $100 per share is $0.50, the expense ratio will be reported as 0.50%. You arrive at this figure by dividing $0.50 by $100 and then multiplying the total by 100 to get the percentage.

In the search for the best fund, it is easy to overlook expense ratios. As we’ll see, expense ratios can vary considerably from one fund to another.

Differences are particularly notable between passively managed index funds and actively managed mutual funds. On average, the expense ratios on active funds are five times higher than on passive funds. This owes to the fact that active funds cost more to operate.

Active management involves human oversight, meaning there will be several people on the payroll whose salaries need covering. Higher volume trading, which the fund practices in an effort to outperform the general market, also results in higher trading fees. This combination gives actively traded mutual funds higher expense ratios than exchange-traded funds (ETFs).

From an investor standpoint, expense ratios can be largely invisible. They don’t appear in the daily price quote of the fund’s share price.

Fortunately, there are various ways to learn a fund’s expense ratio. Fund sponsors typically list the expense ratio on the webpage for each specific fund they manage. It’s also included in the fund’s prospectus, which you should obtain a copy of before investing.

Third-party sources, including financial news websites, can also provide this information. Most financial websites that display individual stock and fund profiles will provide expense ratios. You can also find them listed in fund screeners and analyzers.

Expense ratios cover the cost of running the fund as well as compensating the fund company. But from an investor standpoint, they represent an expense that reduces net investment returns.

For example, if the average annual return on the fund is 10%, but the fund has an expense ratio of 0.50%, the effective net annual return will be 9.50%.

An expense ratio is presented as a single percentage, although it’s actually a collection of various expenses, representing the fund’s total annual operating expenses. Components of an expense ratio include management, marketing, distribution, administrative, compliance, and various other fees necessary to operate a fund.

Mutual funds can also include a separate category of expenses, known as 12b-1 fees. These include distribution and shareholder service fees. Distribution fees compensate brokers who sell shares of the fund and cover various marketing expenses. Shareholder service fees are paid to personnel who provide investors with information and respond to inquiries about the fund.

Though expense ratios are expressed as an annual percentage, they actually accumulate on a daily basis. When you see the price of a fund, quoted each day, it reflects a reduction in the per diem cost of the expense ratio — the total annual cost divided by 365 days.

However, the expense ratio is usually deducted from the fund on a monthly basis. If a fund has an expense ratio of 0.24%, the monthly deduction will be 0.02%, or 0.24% divided by 12 months). If you have a $10,000 position in that fund, the annual expense ratio will be $24. But on a monthly basis it, will be just $2. That’s an amount you’ll hardly notice on a $10,000 balance.

One of the best ways to understand the impact of expense ratios on investment performance is by calculating a few examples.

The table below shows the impact a range of different expense ratios have on investment earnings. For each example, we’ll assume $10,000 invested over 30 years, at an average annual rate of return of 7%.

| Expense ratio | Net annual fees | Net earnings after 30 years |

|---|---|---|

0.75% | $75 | $61,641 |

0.50% | $50 | $66,144 |

0.10% | $10 | $74,017 |

Though the difference in expense ratios from one level to the next may seem small, the impact on net earnings after 30 years is anything but. By investing in a fund with an expense ratio of 0.10%, rather than a comparable fund with a 0.75% expense ratio, you can earn an additional $12,376 after 30 years.

But there’s another way to interpret the additional investment returns. The $12,376 you “earned” on the fund with the lower expense ratio is really comprised of expense ratios not paid. In other words, $12,376 is how much you saved in expense ratios.

The situation becomes even more extreme when you invest with annual contributions, like a 401(k) plan. That’s because retirement investing is long-term in nature, and that’s where expense ratios have the biggest impact.

Let’s assume you’ll contribute $10,000 per year to your 401(k) in each of the next 30 years. If the plan is invested in one or more funds with an average expense ratio of 0.75%, the plan will have $853,968 at the end of 30 years. Conversely, if the plan is invested in funds with an average expense ratio of 0.10%, it will be worth $962,108 at the end of 30 years.

That’s a difference of $108,140 just from investing in funds with a significantly lower average expense ratio.

Expense ratios don’t just vary widely between actively managed mutual funds and passively managed index funds. There is also a notable difference in the average fees charged among different fund categories.

| Sector | Asset-weighted average fees 2021 (%): actively managed funds | Asset-weighted average fees 2021 (%): passively managed funds |

|---|---|---|

US equity | 0.63 | 0.08 |

Sector equity | 0.79 | 0.26 |

International equity | 0.72 | 0.18 |

Taxable bond | 0.47 | 0.09 |

Municipal bond | 0.45 | 0.14 |

Allocation | 0.59 | 0.44 |

Alternatives | 1.10 | 0.65 |

Commodities | 0.60 | 0.37 |

All funds | 0.60 | 0.12 |

Source: Morningstar

As you can see, the difference in expense ratios between the different sectors is substantial. For that reason, you should compare expense ratios of funds by sector, and not with overall averages.

Expense ratios matter because they reduce your net return on investment.

For example, an expense ratio of 0.75% will reduce an average annual return of 7.00% to 6.25%. That might not make much of a difference in any single year. But when multiplied over 10, 20 or 30 years, the difference can amount to thousands of dollars.

Expense ratios can also be a way to evaluate different funds in the same class. Let’s say you’re looking at two index-based ETFs. The performance of each is tied to the same index, but the expense ratio of one fund is 0.12%, while the other charges 0.08%. In this case, since both funds are tracking the same index, your long-term performance will be better choosing the fund with the lower expense ratio.

You can match the expense ratio of a fund against the average for a fund group. For example, if the average expense ratio of all ETFs is 0.12%, you’d want to target funds with even lower ratios.

A website called VettaFi provides a list of the 100 lowest expense ratio ETFs, which could be a starting point for your search. But you should never choose a fund just because it has a very low expense ratio. It may well be that the specific type of fund you’re looking for doesn’t appear on such a list.

A workaround to consider is looking at the portfolios of popular robo-advisors. Many of them list the ETFs used to build their portfolios.

You’ll find there’s a lot of duplication, with many of the same funds appearing across multiple robo-advisors. That’s a clue that a fund is not only one of the leaders in its category but also has a very low expense ratio.

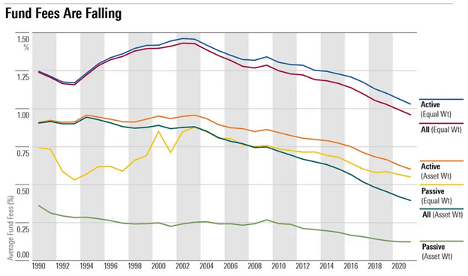

Expense ratios have shown a definite pattern of declining in recent years. That’s good news for investors.

Data from Morningstar showed that average expense ratios are declining across the board. From 2001 to 2021, the asset-weighted average expense ratio of U.S. open-ended mutual funds and ETFs fell from 0.87% to 0.40%. By 2021, the asset-weighted average fee was 0.12% for index funds and 0.60% for actively managed mutual funds.

In fact, there’s been a general trend toward declining expense ratios on funds of all types since the early 2000’s:

Source: Morningstar

The Morningstar report shows investors saved $6.9 billion in fees just from 2020 to 2021 alone. But the longer-term trend is even more encouraging.

Looking at averages across all funds, those with the 2001 average expense ratio of 0.87% will grow to $59,586 after 30 years (assuming a $10,000 initial investment at an average annual return of 7%). Use the 2021 average of 0.40% instead, and the outcome is much better. After 30 years of that expense ratio, the balance will reach $68,032.

Funds with low expense ratios are commonly published in online and print articles titled “Mutual Funds (or ETFs) with the Lowest Expense Ratios.” You can also take advantage of fund screeners. An example is the Fund Analyzer by FINRA, which provides access to the expense ratios of more than 30,000 mutual funds, ETFs, exchange-traded notes (ETNs) and even money market funds.

If you have a large portfolio, or you lack the time to delve into investment fine points like expense ratios, it may be time to choose a financial advisor to manage your portfolio for you. You can do this through online financial advisor databases, such as WiserAdvisor and SmartAsset, which let you choose from hundreds of financial advisors based on the criteria of your choice. Most financial advisors are well aware of the importance of investing in funds with low expense ratios. But it still might be worth mentioning it anyway.

Now that you know what expense ratios are and what they can do, your job is to take steps to minimize them. Choosing funds with low expense ratios is probably the easiest way to improve your long-term investment performance by thousands of dollars.

Mutual funds generally have higher expense ratios than ETFs because there are more actively managed mutual funds than ETFs. Active management requires paying humans to do a job and more frequent trading of securities. By contrast, index funds are passively managed. That means they track underlying indexes, which involves very little human management as well as only infrequent trading.

That said, there have been more actively managed ETFs in recent years, so it’s a good idea to check the expense ratios of ETFs as well as mutual funds.

Fidelity is currently offering four mutual funds with zero expense ratios. Collectively called Fidelity Zero, they consist of: Fidelity ZERO Large Cap Index Fund (FNILX), Fidelity ZERO Extended Market Index Fund (FZIPX), Fidelity ZERO Total Market Index Fund (FZROX), and Fidelity ZERO International Index Fund (FZILX).

Notice that while all four funds are mutual funds, they’re also index funds. That enables Fidelity to eliminate the expense ratios.

In 2021, the average expense ratio on mutual funds was 0.60%. But you can do much better. There are many mutual funds with expense ratios well below average as well as a small handful with no expense ratio at all.

The information presented here is created by TIME Stamped and overseen by TIME editorial staff. To learn more, see our About Us page.