Should You Use Your Credit Card Before It Arrives in the Mail?

Our evaluations and opinions are not influenced by our advertising relationships, but we may earn a commission from our partners’ links. This content is created by TIME Stamped, under TIME’s direction and produced in accordance with TIME’s editorial guidelines and overseen by TIME’s editorial staff. Learn more about it.

When you apply for a new credit card, it's not uncommon to wait 10 to 14 days for your physical card to arrive in the mail. This begs the question, can you actually use a credit card before it arrives? And if so, how exactly does that work?

The reality is, there are several types of credit cards you can use before they arrive in the mail — and even instantly after you're approved. This guide will go over the types of instant approval credit cards you can use right away, which issuers offer them and common pitfalls to watch out for if you need to use a credit card quickly.

Using a credit card number before you receive a physical credit card is possible, but only with certain types of cards from credit card issuers that facilitate this option. As an example, American Express is very upfront about their instant use card offerings, and the same is true for many popular rewards credit cards from Chase (with some exceptions).

There are also some scenarios where you can apply for a credit card during the checkout process for an online purchase, use the line of credit to finance your purchase and receive a bill in the mail later on. At the end of the day, you'll want to consider which credit cards offer instant use or other means to use them virtually if you need to make a purchase with credit now and you can't afford to wait.

Which of the best credit cards make it easy to start shopping right away? Consider the following card types and examples below.

First off, you should know that some card issuers offer instant use cards you can use right away if you're approved. While some of the cards in this niche are offered through retail stores that try to get you to sign up for their co-branded credit card when you make a purchase in-store or online, others are offered through major card issuers.

As an example, you may be asked if you want to apply for the Capital One Walmart Rewards® Mastercard® when you shop in-person at Walmart stores or make an online purchase with the retailer. You can apply for this card during the checkout process either way, and you can use your line of credit instantly upon approval. Capital One also notes that, if they can't approve you for the Mastercard version of this instant use credit card, you may automatically get assigned the Walmart Rewards® Card that only works for Walmart purchases instead.

As we mentioned already, American Express is also good about making their cards instantly available to consumers. On the American Express website, they say that eligible customers can get their card number right away after approval, and that they can instantly add it to a digital wallet like Apple Pay, Samsung Pay, Google Pay or Amazon Pay to begin making purchases.

American Express says that all of their consumer cards and charge cards are eligible for instant card use, but that not all card applicants are. Amex also goes further to say eligibility is based on their ability to "authenticate you" during the application process.

Chase offers a similar option with its "Spend Instantly" promotion. Essentially, you can apply for a card for instant use and begin using your card number after adding the card to an eligible digital wallet. While many rewards credit cards from Chase are eligible, the card issuer says card_name, card_name, Aeroplan, Chase Freedom Flex, Amazon, Amazon Prime, Disney, Disney Premier and business credit cards are ineligible to be added to a digital wallet directly after approval.

Additional instant use cards to consider include:

card_name is a solid flat-rate earnings card with annual_fee_disclaimer annual fee. Although the 1.5% cash back doesn’t seem impressive at first glance, it becomes more valuable when combined with other rewards cards from Chase that can be redeemed for a far greater value.

This card is recommended for everyday use, whether for doctor copays or big box store purchases. It can be a large earner for cardmembers who want to get the most out of their everyday spending.

Introductory Offer:

Intro Card Rewards:

After the First Year or $20,000 Spent Card Rewards:

Additional Benefits:

Member FDIC

Some credit card issuers also offer another alternative that leads to instant use — virtual card numbers. However, virtual card numbers work in a different manner than physical cards and other instant use cards, and they are offered on a more limited basis.

With a virtual account number, you get a one-time-use card number you can use to make a purchase online. Virtual card numbers also require the use of a personal identification number (PIN) that allows you to prove you are the person approved to make the transaction.

Only a few card issuers offer virtual card numbers that can be used right away, which limits your options in this realm. A good option includes the card_name for consumers in good credit standing.

You may also notice that some airline and hotel brands try to entice you into signing up for their co-branded credit cards when you're making a purchase. In this scenario, you have the option to apply for the card and charge your travel purchase instantly, then wait for your physical card to arrive in the mail before using it for more spending.

RELATED: Best Airline Credit Cards

RELATED: Best Hotel Credit Cards

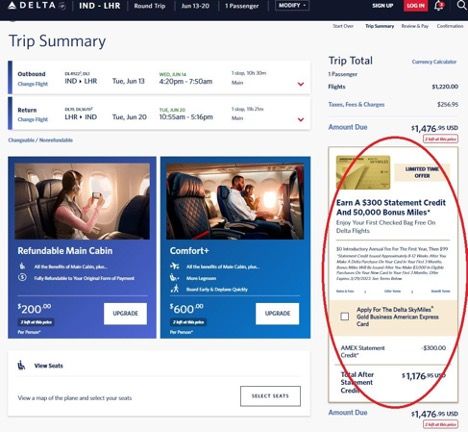

When you book a flight with Delta Air Lines, for example, this is exactly what happens. Not only does Delta try to get you instantly approved for one of their co-branded credit cards, but they offer statement credits and welcome offers to entice you into signing up.

Why would anyone want to use their credit card number right away? There are plenty of scenarios where instant card use makes sense.

Because credit cards offer consumers robust protection against unauthorized purchases, instant use cards don't come with any additional risks you don't face with a physical credit card. In fact, the Federal Trade Commission (FTC) points out that the absolute most consumers can be liable for when fraud occurs with a credit card is capped at $50. And, if your account number is used but your card isn’t lost or stolen, you're liable for $0 in fraudulent charges made with your card either way.

Beyond that, the best credit cards all offer $0 liability protection on their own regardless. If a hacker is somehow able to access your card number, whether your real one or a virtual card number, you should call your card issuer to notify them of the fraud immediately. At that point, they will assign you a new card number and send you a new physical card in the mail.

The process for adding a credit card to a digital wallet varies based on the wallet you're using and the card issuer. If you are trying to add a Chase credit card to a digital wallet via the Chase mobile app, for example, you would open the Chase app, choose the Chase card you want to add, scroll down to “Account Services” and select “Digital Wallets.” At that point, you could choose which digital wallet you want to use from Apple Pay, Google Pay or Samsung Pay.

Yes. Many Capital One credit cards offer a service called Eno that lets you apply for virtual card numbers you can use right away.

If American Express is able to authenticate your identity when you apply for one of their cards, you may be provided with an instant use credit card number you can add to a digital wallet within minutes of approval.

Many credit cards allow you to start making purchases on the day you apply, but you typically will not receive your physical card in the mail for a few days up to 14 days.

The information presented here is created by TIME Stamped and overseen by TIME editorial staff. To learn more, see our About Us page.