Citi ThankYou Rewards Program Guide 2024

Our evaluations and opinions are not influenced by our advertising relationships, but we may earn a commission from our partners’ links. This content is created by TIME Stamped, under TIME’s direction and produced in accordance with TIME’s editorial guidelines and overseen by TIME’s editorial staff. Learn more about it.

Citi ThankYou Rewards is the card issuer's answer to similar flexible rewards programs from American Express, Capital One, and Chase. You can earn points in the Citi ThankYou Rewards program with a selection of credit cards from Citi, including both cash back credit cards and travel credit cards. That said, you'll unlock a wider selection of redemption options for rewards if you opt for a Citi travel credit card like the Citi Strata Premier℠ Card.

The good news about Citi ThankYou Rewards is the fact these points are so easy to earn. You can sign up for Citi credit cards to earn generous welcome offers upfront, yet you can also earn points for each dollar you charge in purchases to your card. From there, Citi ThankYou points are worth an average of 1.8 cents each depending on how you redeem them. We'll break down all the ways you can use Citi ThankYou points and each option's average point values in the sections below.

The value of Citi ThankYou points is based on how much various redemption options yield, including cash back, gift cards, travel through the Citi portal and transfers to Citi airline and hotel partners. Note that the average value of rewards is boosted by the outsized redemptions you can get with Citi airline and hotel partners when redeeming miles for a premium travel redemption.

Also note that the maximum average value of Citi ThankYou points (1.8 cents per point) is predicated on having a Citi travel credit card like the Citi Prestige® Card, which is no longer accepting new applicants. If you opt for a Citi credit card that is geared to earning cash back instead, you'll get a lower average point value overall.

There are several credit cards that earn Citi ThankYou points. The right card for you depends on which categories you spend the most in and how you want to redeem rewards.

| Card | Welcome offer | Annual fees | Credit score |

|---|---|---|---|

Citi Strata Premier℠ Card | bonus_miles_full | $95 | credit_score_needed |

Citi Prestige® | No longer accepting new applicants | $495 | Excellent |

Citi Rewards+® Card | bonus_miles_full | $0 | credit_score_needed |

Citi Double Cash® Card | bonus_miles_full | annual_fees | credit_score_needed |

Citi Custom Cash® Card | bonus_miles_full | annual_fees | Excellent, Good |

No longer accepting new applicants | $0 | Good |

The value of Citi ThankYou points depends largely on how you decide to cash them in. Here's a rundown of the average values for these points based on the available redemption options.

First off, you should know that the Citi ThankYou program has its own travel portal that works similar to the Chase travel portal or AmexTravel.com. This portal lets you book airfare, hotels, car rentals, and other travel directly with your points for ultimate convenience.

Point redemptions through the Citi travel portal are worth one cent each no matter the type of travel you redeem for. If you have 30,000 Citi ThankYou points, and you go to book airfare, for example, your points will be worth $300 in flights.

The good news about the Citi travel portal is the fact you can book with a combination of points and cash. If you had 30,000 Citi points and found a flight for $400, for example, you could redeem your rewards for a $300 cost reduction, pay the $100 remaining fare in cash and book the exact flight you wanted.

Citi offers a range of airline and hotel partners that can offer exceptional value if you know how to use them. These partners include both airlines and hotel partners, including popular options like Air France /Flying Blue, Virgin Atlantic, Accor Live Limitless and Wyndham Rewards.

Note that consumers with a Citi travel credit card get access to all the transfer partners in the program, whereas cash back credit card customers only get access to a few. Ultimately, this is why having the Citi Strata Premier℠ Card or the older Citi Prestige® gets you a higher average point value overall.

The chart below shows the full list of Citi ThankYou transfer partners and their transfer ratios:

| Transfer partner | Transfer ratio (Citi points to partner) |

|---|---|

Aeromexico Rewards | 1,000:1,000 |

Accor Live Limitless | 1:000: 500 |

Avianca LifeMiles | 1,000:1,000 |

Cathay Pacific | 1,000:1,000 |

Choice Privileges | 1,000:2,000; (1,000:1,500 for cardholders with the Citi Rewards+® Card, Citi Custom Cash® Card, Citi Double Cash® Card, or AT&T Points Plus® Card From Citi) |

Emirates Skywards | 1,000:1,000 |

Etihad Guest | 1,000:1,000 |

EVA Air | 1,000:1,000 |

Flying Blue (Air France) | 1,000:1,000 |

JetBlue TrueBlue | 1,000:1,000; (1,000:800 for cardholders with the Citi Rewards+® Card, Citi Custom Cash® Card, Citi Double Cash® Card, or AT&T Points Plus® Card From Citi) |

Qantas Frequent Flyer | 1,000:1,000 |

Qatar Airways | 1,000:1,000 |

Shop Your Way® | 1:10 |

Singapore Airlines KrisFlyer | 1,000:1,000 |

Thai Royal Orchid Plus | 1,000:1,000 |

Turkish Airlines Miles&Smiles | 1,000:1,000 |

Virgin Atlantic | 1,000:1,000 |

Wyndham Rewards | 1,000:1,000; (1,000:800 for cardholders with the Citi Rewards+® Card, Citi Custom Cash® Card, Citi Double Cash® Card, or AT&T Points Plus® Card From Citi) |

How can you get an average value of 1.8 cents per point or more with Citi ThankYou partners? You can do this by moving rewards from an eligible Citi account to a partner (usually an airline, but sometimes a hotel partner) and making a premium redemption from there.

Consider this example:

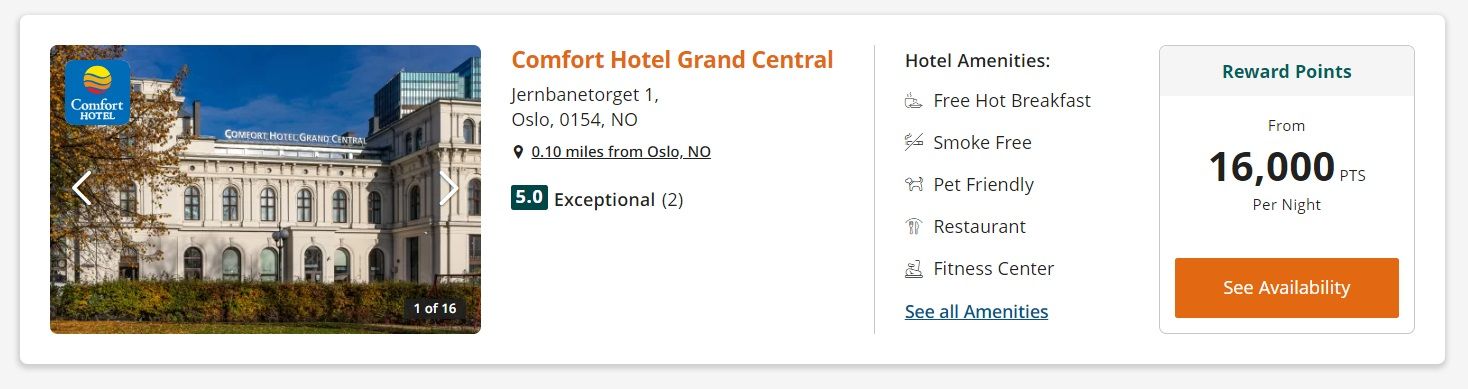

Imagine you want to travel to Oslo, Norway in June of next year, and you have a stash of Citi ThankYou points to spend. You could transfer your rewards to the Choice Privileges program and get a transfer ratio of 1:000:2,000, thus doubling your rewards to spend on hotels.

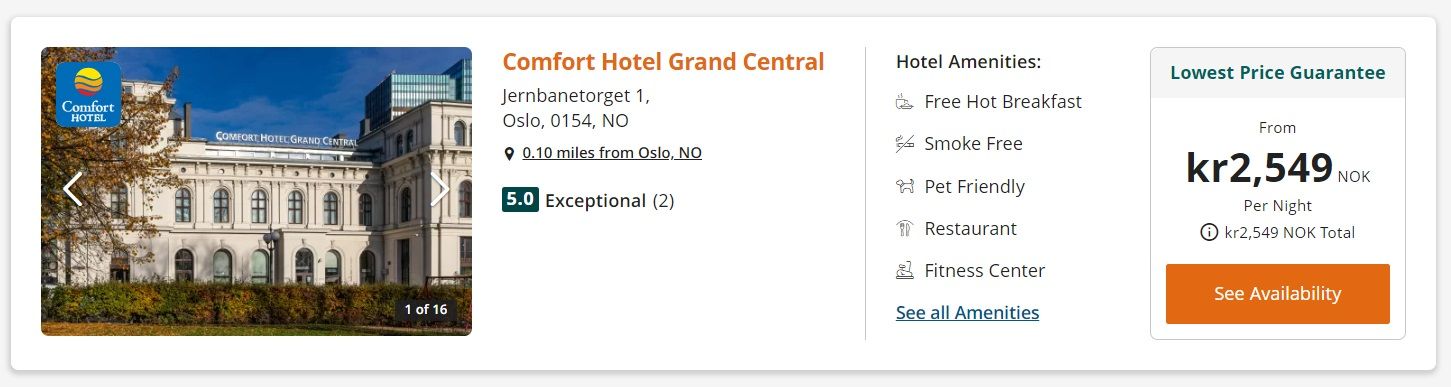

In that scenario, you could transfer 8,000 Citi points to this program, wind up with 16,000 Choice Privileges points and book the Comfort Hotel Grand Central in Oslo for 16,000 points per night.

This hotel has a nightly cash rate of 2,549 Norwegian Krones in June, or $234 USD, so you would be getting a rewards value of a little under 3 cents per point for the 8,000 Citi ThankYou points you transferred.

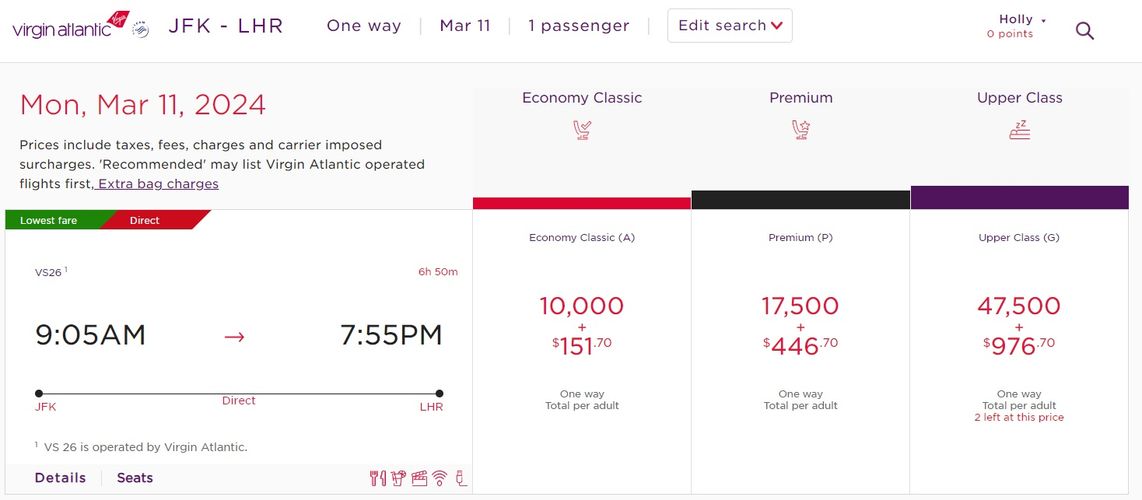

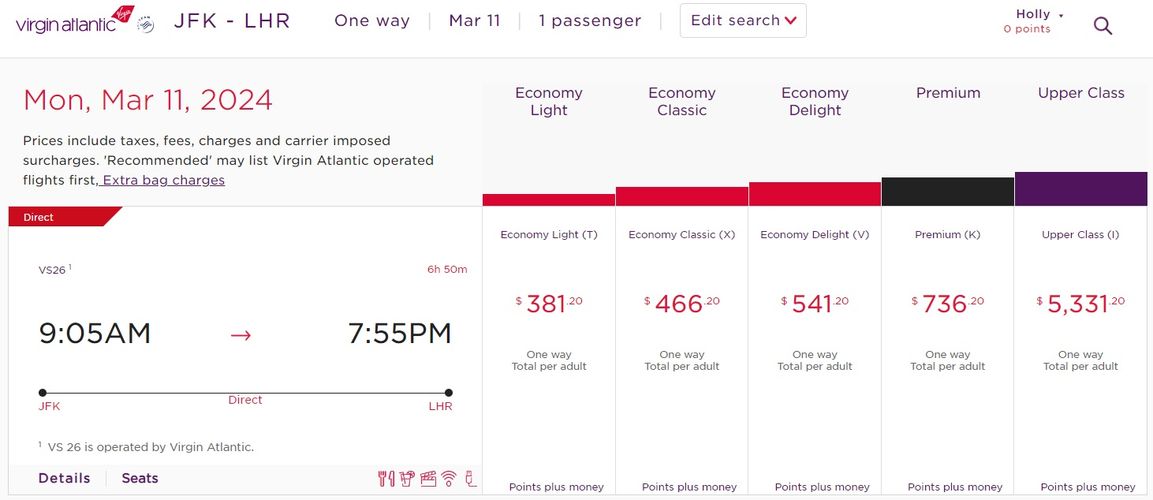

Now let’s look at an airline partner—specifically, Virgin Atlantic. Imagine you wanted to fly from New York City (JFK) to London, England (LHR). In that scenario, you may be able to book a one-way flight for as little as 10,000 points plus $151.70 in economy class.

For the same travel date, however, you could book the same flight for $466.20 in cash.

When you subtract the $151.70 in airline taxes and fees, this leaves you with a price difference of $314.50. Since the flight would set you back 10,000 Virgin Atlantic points that transfer from Citi at a 1,000:1,000 ratio, this gets you a point value of over 3 cents per point.

You can also use Citi ThankYou points to make purchases on Amazon.com, and doing so will get you a rewards value of 0.8 cents per point. This means 10,000 Citi ThankYou points are worth $80 in Amazon merchandise, which is not the best redemption but not half bad, either.

The same redemption value is also offered for purchases made through PayPal, which could include any of the millions of global retailers that let you pay with this online payment platform.

You can also redeem Citi ThankYou points for merchandise with other retailers, including Walmart and CVS. However, the redemption values are not great at all since you have to redeem 1,250 Citi ThankYou points for $10 in merchandise.

Also, you can only redeem rewards at these retailers in blocks of $10 for 1,250 points, so this can leave you paying the cash difference for purchases even when you have extra Citi points to spare.

Having the Citi Prestige® , Citi Strata Premier℠ Card, the Citi Rewards+® Card, the Citi Double Cash® Card, or the AT&T Points Plus® Card From Citi helps you get a rewards value of one cent per point in this category.

Citi credit cards also let you redeem for cash back in the form of statement credits, direct deposit, or a check in the mail.

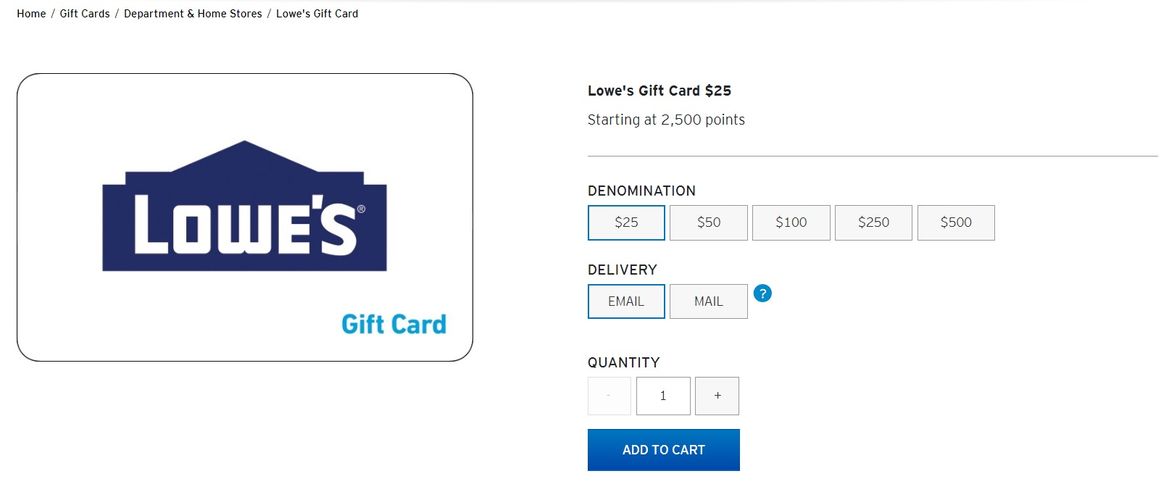

You can also redeem Citi ThankYou points for a broad range of gift cards from restaurants, retailers, travel brands, and more. The point value you can get for gift cards varies, but you can easily get one cent per point in value if you're flexible on the type of gift card you get.

You can sometimes even get more than one cent per point in value due to Citi's gift card "sales" that change over time. Here's an example of a $25 Hulu gift card you can redeem for 2,250 points. You could also get a $100 Hulu gift card for 9,000 points.

The Citi ThankYou points calculator can help you figure out what your rewards are worth based on how you plan to redeem them.

Citi ThankYou points are a flexible rewards currency you can earn with various Citi credit cards, but there are other flexible currencies out there. The most popular programs include Chase Ultimate Rewards, American Express Membership Rewards and the Capital One Miles programs.

Each of these programs offer the option to redeem rewards through a travel portal or transfer points to various airline and hotel programs if you have an eligible rewards credit card. However, each program has its own unique transfer partners to learn and understand, so you'll want to compare these programs before you decide.

Also, Chase Ultimate Rewards, American Express Membership Rewards, and Capital One Miles let users redeem rewards for non-travel options like cash back, gift cards, and merchandise, albeit with different rewards values overall.

If you're interested in checking out alternatives to the Citi ThankYou Rewards program, consider the following programs and rewards credit cards:

| Program | Popular cards to check out |

|---|---|

American Express Membership Rewards | |

Capital One Miles |

|

Chase Ultimate Rewards |

The Citi ThankYou Rewards program lets users combine all their rewards points in a single account provided all points belong to the same person. To do this, Citi says you should log into your Citi account and head to the section that says "Manage My Account." From there, you select the option to "Combine My Account" from a drop down menu.

There may be notable benefits that come about if you combine Citi ThankYou points across multiple cards and you happen to have the Citi Prestige®. In this scenario, combining Citi points from other Citi ThankYou cards into your Citi travel card account would unlock the potential to transfer points to all Citi ThankYou airline and hotel partners instead of just a few.

You can also share Citi ThankYou points with someone else and without incurring any fees. There are some "gotchas" though with this option, so make sure you read the fine print and understand the terms before you move your points to another person's account.

Essentially, Citi lets you share up to 100,000 Citi ThankYou points with another person within a calendar year; the same maximum applies to how many points someone can receive. However, shared points must be used within 90 days of the transfer or they become invalid. This means you should only transfer points to another person if they can use them right away.

Also, people who have the Citi Double Cash® Credit Card are not eligible to share points.

You can redeem your rewards however you want, and there's no need to feel bad about getting less than optimal value. However, some redemptions are less lucrative than others.

The worst uses of Citi ThankYou points include:

At the end of the day, you should always try to get at least one cent per point in value for Citi ThankYou points. After all, all Citi cards available to new applicants today offer one cent per point if you redeem for options like cash back or statement credits, so this is the bare minimum you'll want to shoot for.

If you love to travel, you can also get one cent per point in value for airfare, hotels and more through the Citi ThankYou portal. Even better, transferring points to partners can get you an average value of 1.8 cents per point and potentially more than that.

The Citi ThankYou Rewards program is best for people who travel and want to sign up for a travel credit card. However, Citi customers with cash back cards like the Citi Rewards+® Card and the Citi Double Cash® Card still get access to a variety of redemption options, plus point transfers to a handful of airline and hotel partners.

If you are looking for a flexible rewards currency, however, you'll also want to compare this program to American Express Membership Rewards, Capital One Miles and Chase Ultimate Rewards. Doing so can help you earn the most valuable rewards based on your normal spending and redemption habits.

If you redeem Citi ThankYou points for cash back, 50,000 points can be worth $500. If you redeem for point transfers to partners, 50,000 points are worth an average of $900.

Generally speaking, 100 Citi ThankYou points equal $1.

A stash of 10,000 Citi points can be worth $100 in cash back or an average of $180 in travel if transferred to airline or hotel partners and redeemed wisely.

You can redeem 20,000 Citi points for $200 in cash back or travel in most cases. If you transfer points to an airline or hotel partner first, you'll get an average of $360 in value.

The information related to Citi Double Cash® Card has been collected by TIME Stamped and has not been reviewed or provided by the issuer or provider of this product or service.

The information related to Citi Strata Premier℠ Card has been collected by TIME Stamped and has not been reviewed or provided by the issuer or provider of this product or service.

The information related to Citi Custom Cash® Card has been collected by TIME Stamped and has not been reviewed or provided by the issuer or provider of this product or service.

The information related to Citi Rewards+® Card has been collected by TIME Stamped and has not been reviewed or provided by the issuer or provider of this product or service.

The information presented here is created by TIME Stamped and overseen by TIME editorial staff. To learn more, see our About Us page.