Can You Pay A Car Loan With A Credit Card?

Our evaluations and opinions are not influenced by our advertising relationships, but we may earn a commission from our partners’ links. This content is created by TIME Stamped, under TIME’s direction and produced in accordance with TIME’s editorial guidelines and overseen by TIME’s editorial staff. Learn more about it.

As a consumer, you may use credit cards to pay for so many purchases and activities that you simply assume you can use one to pay for a car loan. While it is possible in a limited number of circumstances, it’s not permitted in most, especially on a recurring basis.

As it turns out, the answer to this question is pretty complicated. Though there may be times when paying a car loan with a credit card can be done– and it may even make sense financially–it’s far from being a common practice. If you’ve recently taken a car loan, the best strategy is not to plan on using your credit cards to pay your car loan.

The short answer is yes, but with lots of limitations. First, while the practice may be permitted by credit card issuers, it’s rarely welcomed by auto lenders—especially when it comes to making monthly payments. Credit cards charge merchants processing fees of up to 3.5% on payments, which is why car lenders frown on credit card payments.

If you are considering using a credit card to make a car loan payment, contact the card issuer to make sure it’s permitted. Even more importantly, reach out to the car loan company to find out if they accept credit card payments, and what the procedures are if they do.

But apart from the limitation of making car payments, there may be other situations where you can use a credit card in connection with a car loan.

One prominent example is using a 0% introductory APR balance transfer offer to pay off the remaining balance on a car loan. Some credit card companies offer this introductory benefit for between 12 and 21 months. If you can pay off a remaining car loan balance using this offer, and then pay off the balance transfer within the interest-free timeframe, a credit card can be a good strategy.

Not surprisingly, an entire class of credit cards is available specifically for the car industry. Major auto manufacturers have partnered with banks to offer credit cards that provide rewards that can be used for the purchase of new or used cars. The rewards are quite generous, offering thousands of dollars toward the purchase of a new vehicle. We’ll be covering a couple of those cards in this guide.

In most cases, however, the ability to use a credit card to purchase a car will be severely limited by the credit limit on the card. Not only is there an overall credit limit on each credit card, but there’s usually a lower limit set for balance transfers and cash advances. With the average price of a new car now well in excess of $40,000, a credit card is likely to represent no more than a partial payment on the purchase of a new car.

We’re including credit cards below that can be used for the purchase of a car, the payoff of an existing loan balance, to make a monthly car payment or any combination of the three.

Just as there are credit cards issued for specific merchants and travel companies, there are also credit cards dedicated to the auto industry. One prominent example is My GM Rewards® MasterCard®, issued by Goldman Sachs.

As you might imagine, the card is designed specifically to help you to purchase a GM vehicle. That starts with awarding 15,000 bonus points when you spend at least $1,000 within the first three months of opening your account. That’s accompanied by a 0% introductory APR on purchases for 12 months. But it gets better.

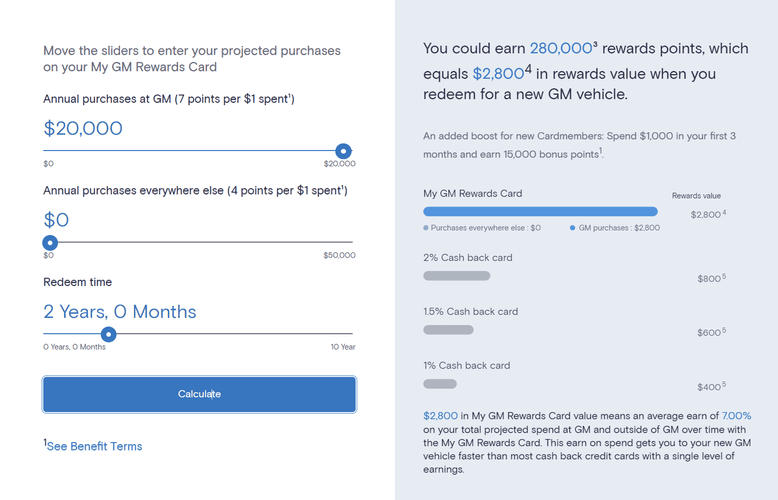

When you purchase a GM vehicle, you will earn seven points for each dollar spent. For example, you can earn up to 280,000 points—worth $2,800—when you spend at least $20,000 toward a brand-new GM vehicle. Rewards points accumulated from other purchases can also be used for the purchase of a new GM vehicle.

You can also redeem points worth up to $1,000 for the purchase of a certified pre-owned vehicle.

The My GM Rewards® MasterCard® doesn’t provide a balance transfer provision. But it does offer cash advances, which may be used to make your car payment. If you do, the APR will be a steep 29.99%, though there is no cash advance fee charged.

Toyota offers the Toyota Rewards Visa® Credit Card which can similarly be used in connection with the purchase of one of its vehicles. The card is issued through Comenity Capital Bank. Rewards points can be redeemed on service, parts, accessories, and toward eligible Toyota vehicle purchases.

The card also offers a balance transfer capability, but it is subject to both a high APR and a balance transfer fee. For this reason, a balance transfer using this card to pay off an existing car loan may not make financial sense. It may also be possible to make monthly car payments using the card, but there is a high APR and cash advance fee here as well.

The primary purpose of this card would be the redemption of rewards points for the purchase of a new vehicle.

According to Kelly Blue Book, the average cost of a brand-new car in 2023 is $48,528. It would be a stretch for the average person to come up with that much cash to pay for a car. But if you are in a position to do so, you eliminate the burden of a monthly payment, and own your vehicle debt free.

Just as the cost of new cars has risen, so has the value of used cars. That means your current vehicle may be worth more than you think. And that can represent a substantial trade-in on your next vehicle. It probably won’t cover the full cost of the new car, but it will result in a much lower loan amount.

A personal loan can be a viable alternative to using a car loan to purchase a vehicle. The rates on personal loans range between 5.99% and 35.99%. They are generally higher than the rates on car loans because they are completely unsecured. And many personal loan lenders charge origination fees that can range between 1% and 10% of the loan amount.

But personal loans have the advantage of enabling you to either purchase a vehicle or pay off an existing car loan in a way that will enable you to own your vehicle free and clear.

Personal loans are widely available at banks and credit unions, but the loan amounts are normally no more than a few thousand dollars. Larger amounts are available through online personal loan lenders, such as LendingClub and Upstart, which offer personal loans of up to $40,000 and $50,000, respectively. Even larger amounts are available through Lightstream, which offers loans up to $100,000.

| Company | APR | Loan amount | Term | Min. credit score |

|---|---|---|---|---|

LendingClub | 8.91% to 35.99% | $1,000 to $40,000 | 24 to 60 months | 600 |

Upstart | 7.80% to 35.99% | $1,000 to $50,000 | 36 or 60 months | 300 |

LightStream | 6.94% to 25.29% | $5,000 to $100,000 | 24 to 240 months | Good |

For many consumers, the real problem of a car loan isn’t the loan itself, but a very high interest rate that results in a crushing monthly payment. This could have been the outcome if you had less-than-perfect credit at the time you made the original purchase. If your credit has improved since, the best strategy may be to refinance into a brand-new loan.

Nationwide lenders specializing in car loan refinances include the following:

| Company | Loan amount | Term | Min. credit score |

|---|---|---|---|

Refi Jet Car Refi | Up to $100,000 | 48 to 84 months | 550 |

PenFed Car Refinance | Up to $150,000 | 36 to 84 months | Undisclosed |

Bank of American Auto Loans Refi | Up to $100,000 | 12 to 75 months | 580 |

Consumers Credit Union Auto Loan Refi | Up to $150,000 | Up to 96 months | 620 |

Open Road Auto Loan Refi | Up to $100,000 | 36 to 84 months | 500 |

RateGenius Auto Loans Refi | $8,000 to no-max | 36 to 72 months | 550 |

Paying a car loan with a credit card makes sense in a small number of cases, and then only for a short term. For example, if using a credit card to make a monthly car payment will prevent your car loan from going into default, it may be worth the effort. And if you have a very high interest rate on your car loan and can replace it with either a 0% balance transfer or a credit card with a lower rate, this may also be a smart strategy.

But in most cases, the practice should be avoided. Credit cards typically carry higher rates than car loans and require high fees to access the funds. You’ll also be replacing one form of debt with a fixed interest rate and payment with another that has a variable rate, and no definite timetable for payoff.

In summary, using a credit card to pay a car loan has the potential to turn a temporary problem into a long-term headache.

Many credit cards will permit you to make car payments, but they will be considered cash advances. That means they’ll carry the highest interest rate and come complete with an upfront cash advance fee.

If you’re unsure whether your credit card issuer will permit car payments, contact customer service. Even more important is to contact the car loan company to learn if it accepts credit card payments. Most don’t.

Generally, no. Credit cards nearly always have a higher interest rate than car loans. But they are also a form of variable-rate financing, with an indefinite repayment term that can go on for many years. And for most consumers, the credit limit on a credit card will be insufficient to purchase a vehicle.

The best use of a credit card in connection with vehicle financing may be either to make a down payment or to pay off a remaining car loan balance. It may make sense only if it can be done with a 0% APR offer on a credit card. And even then, it should be done only if the balance transfer can be paid off before interest applies on the card.

Even if your credit card issuer allows it, your auto lender may not. Credit cards charge merchant fees ranging between 1.5% and 3.5%. As a result, car lenders will not receive full payment after the fees are deducted from the remittance they receive from the credit card issuer.

The information presented here is created by TIME Stamped and overseen by TIME editorial staff. To learn more, see our About Us page.