How Much Are American Airlines Miles Worth?

Our evaluations and opinions are not influenced by our advertising relationships, but we may earn a commission from our partners’ links. This content is created by TIME Stamped, under TIME’s direction and produced in accordance with TIME’s editorial guidelines and overseen by TIME’s editorial staff. Learn more about it.

American Airlines miles are worth approximately 1.5¢ each on average, although the final value you get for your miles will depend on how you redeem them. You may get a lower redemption value if you book travel during peak travel times, or if you don't have the flexibility to consider alternative destinations and dates. You can also get a lot more than the average redemption value if you find a low-cost award. Redemptions in a premium cabin, especially for international itineraries, can also offer better value for each mile you cash in.

Unfortunately, figuring out how much American Airlines miles are worth became much more difficult in April of 2023. That's when the frequent flyer program fully embraced its planned move to dynamic pricing, meaning the cost of awards can now go up or down based on the time of year, demand, and other factors.

American Airlines still publishes an award chart that shows the "estimated starting values" for one-way trips, which can be helpful to give you an idea. However, you'll still want to do the math for awards to know if you're getting a good deal — or if you should book your flight using a different rewards currency.

Below we explain how to calculate the value of American miles before you redeem for flights, other redemption options at your disposal, and how you can earn more miles over the long haul.

The value of an award ticket with the American AAdvantage program is loosely tied to the cost of a flight. However, there are always outliers and situations where you can get outsized value for your rewards.

To figure out how much value you'll get with American miles, compare the cash price of booking airfare to the cost of booking with miles, minus airline taxes and fees. This lets you get an approximate idea of how much each mile you redeem is worth —an important factor that can help guide you in your decision.

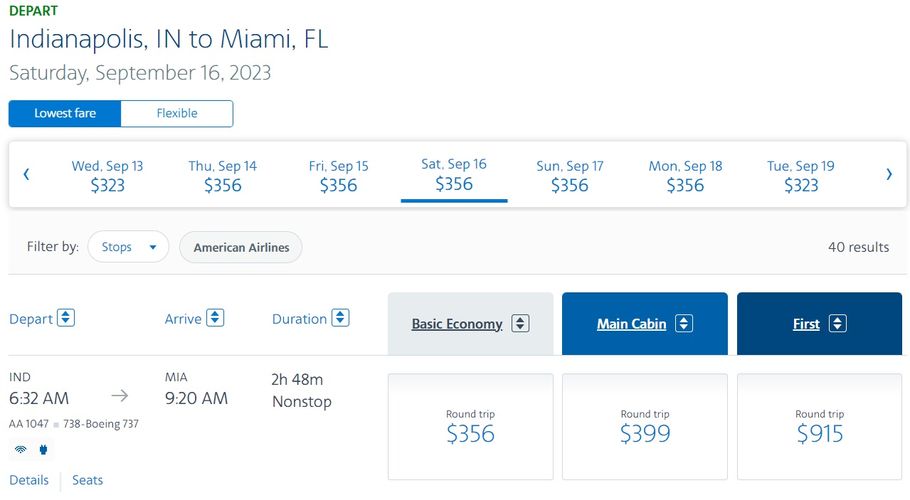

Consider this example that shows the cash price for a round-trip flight from Indianapolis, Indiana (IND) to Miami, Florida (MIA) in September of 2023. As you can see, a round-trip flight between these two cities would set you back $399 if you paid in cash and wanted to fly in the main cabin without dealing with the drawbacks of basic economy.

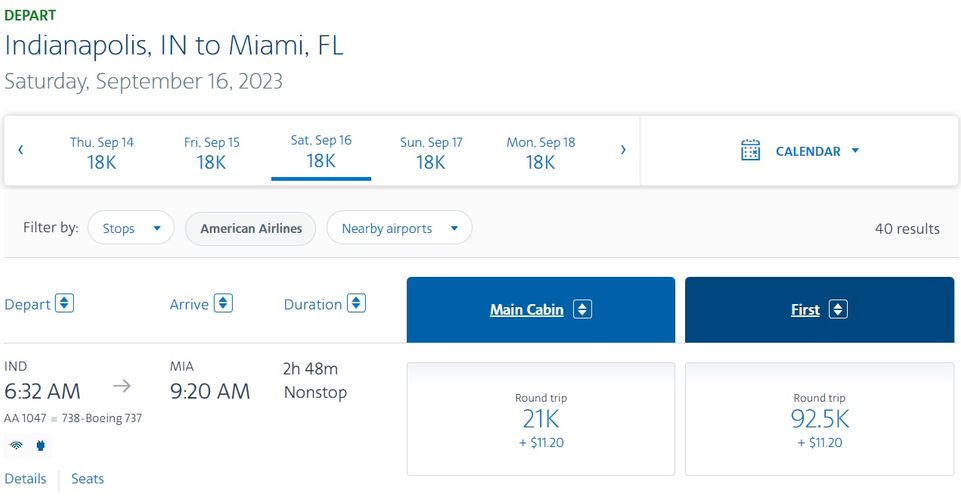

In the meantime, you could book the same round-trip flight in the main cabin on the same dates for 18,000 to 21,000 American miles plus $11.20 in taxes and fees depending on the itinerary you choose.

To figure out the American Airlines miles value, you would take the cash price and subtract the airline taxes and fees. From there, you would divide the remaining cash price by the number of miles required.

So, if you booked the flight for 18,000 miles plus $11.20, you would be getting approximately 2.15¢ per American mile.

($399 – $11.20) / 18,000 miles = 2.15¢ per mile

If you booked the itinerary that costs 21,000 miles plus $11.20, on the other hand, you would be getting approximately 1.85¢ per mile.

($399 – $11.20) / 21,000 miles = 1.85¢ per mile

That's a really great redemption, but you should know this specific example isn't always the norm. The average value of American miles is around 1.5¢ each and, in some instances, you get much less value for your miles.

As an example, a round-trip flight in main cabin economy from Indianapolis, Indiana (IND) to Punta Cana, Dominican Republic (PUJ) could set you back something like 41,500 American miles plus $121.15 in airline taxes and fees at a time when the cash price of the flight is only around $550.

In this example, you're only getting slightly over 1¢ per value for each mile you redeem.

$550 – $121.50) / 41.500 miles = 1.03¢ per mile

The American AAdvantage program, which lets you earn American miles when you fly with American Airlines or partners or participate in other qualifying activity, isn’t the only frequent flyer program to consider. There are others that let you earn a rewards currency that's tied to a specific airline, and some may make more sense for you depending on the airport(s) you typically travel from.

The table below shows how American AAdvantage miles stack up to miles from competing programs. These figures are based on averages.

| Rewards program | Value of average mile |

|---|---|

Delta SkyMiles | 1.16¢ |

Alaska MileagePlan | 1.5¢ |

American AAdvantage | 1.5¢ |

JetBlue TrueBlue | 1.5¢ |

Southwest Rapid Rewards | 1.35 ¢ |

United MileagePlus | 1.2¢ |

There are quite a few ways to rack up American Airlines miles, and that's especially true if you're a frequent flyer. If you're willing to get a co-branded American Airlines credit card, shop through a portal, or join the airline's dining club, you'll be able to earn miles even faster.

Here's an overview of all the ways you can rack up American miles.

Non-elite American flyers earn a base rate of five miles for each dollar spent, whereas Gold members, Platinum members, Platinum Pro members, and Executive Platinum members earn 40%, 60%, 80%, and 120% more miles per dollar spent, respectively.

You can also earn American miles when you fly with participating partner airlines, although the exact way your miles accrue depends on the partner itself. This page on the American Airlines website lets you compare how miles accrue with various partner airlines and explains other requirements that apply.

Like other frequent flyer programs, the American AAdvantage program offers several co-branded credit cards that let you earn miles (also called Loyalty Points) you can redeem for flights and other options. These airline credit cards let you earn miles whether you actually fly with the airline or not, and some come with money-saving benefits like free checked bags and lounge access.

Notable American Airlines credit cards include:

| Card name | Bonus rewards | Regular APR | Foreign transaction fees | Annual fees | Credit score needed |

|---|---|---|---|---|---|

American Airlines AAdvantage® Mile Up® Mastercard® | 15,000 AAdvantage bonus miles | 21.24% – 29.99% Variable | 3% | $0 | Good, Excellent |

card_name | bonus_miles | reg_apr,reg_apr_type | foreign_transaction_fee | annual_fees | credit_score_needed |

card_name | bonus_miles | reg_apr,reg_apr_type | foreign_transaction_fee | annual_fees | credit_score_needed |

AAdvantage® Aviator® Red World Elite Mastercard® | 50,000 miles | 21.24%, 25.24%, or 29.99%, variable | None | $99 | Good to excellent |

American Airlines AAdvantage® Mile Up® Mastercard®: This is the only American Airlines ccredit card with no annual fee, and it earns two miles per dollar spent on grocery store and eligible American Airlines purchases and one mile per dollar spent on other purchases.

card_name: This premium airline credit card carries an annual fee of annual_fees, and cardholders get a complimentary Admirals Club® membership that is valued at $650. Other perks include free checked bags on domestic American Airlines itineraries, priority boarding, a fee credit toward Global Entry or TSA PreCheck membership, 25% off in-flight purchases, and 10,000 additional loyalty points after spending $40,000 on the card each qualifying year.

card_name: This business credit card offers a generous sign-up bonus as well as bonus miles on gas, car rentals, telecommunications merchants, cable and satellite providers. Cardholders also get free checked bags on domestic American Airlines itineraries, preferred boarding, 25% off eligible in-flight purchases, and more.

AAdvantage® Aviator® Red World Elite Mastercard®: This airline credit card from Barclays lets you earn the sign-up bonus of 50,000 miles after paying the $99 annual fee and making a purchase within the first 90 days. Cardholders also qualify for a free first checked bag on eligible domestic itineraries, preferred boarding, $25 in statement credits toward Wi-Fi purchases, 25% off eligible in-flight purchases, and more.

The American AAdvantage program partners with a range of hotel brands and car rental companies to help you earn more miles when you travel. For example, you can earn miles when you book a stay with Hyatt Hotels or Marriott International, or when you book a hotel through Rocketmiles.com. You also earn miles when you book a car rental with Avis and Budget through the American Airlines website.

Lots of miles can be earned by booking vacation packages and cruises through the American Airlines website. It's possible to earn 25,000 miles or more on eligible vacation packages that combine your hotel stay with airfare, and many cruise lines offered through the portal offer 10,000 miles plus perks like cabin upgrades and onboard credits.

The American AAdvantage dining program lets you earn miles for dining at eligible restaurants and paying with a credit or debit card that's linked to your account. This program also gives newcomers a chance to earn a bonus of 500 miles.

You can also earn American miles for shopping through the airline's shopping portal, called American eShopping. This portal lets you earn bonus miles for making eligible purchases at more than 1,200 online stores, including Apple, Kohl's, Macy's, and Office Depot. All you have to do is log in through the portal, click on the store of your choice, and buy something, using any payment method you want.

There are quite a few ways to redeem American Airlines miles, but the best option is always going to be flights. You can use American miles for flights to more than 1,000 destinations around the world, with miles also being redeemable for travel with the company’s partners such as Alaska Airlines, British Airways, Cathay Pacific, Qatar Airways, and more. It's also worth noting that one-way domestic flights start at just 7,500 miles plus airline taxes and fees, which can be an incredible deal depending on your travel dates and itinerary.

You can also redeem American miles for upgrades to the next cabin up on American, British Airways, and Iberia flights. Alternate redemption options for American miles include:

You should use your American miles to book travel any time you find an award flight that lets you get at least the average value for each mile you redeem. If you find a domestic flight or an international itinerary that lets you get 1.5¢ per mile, you should probably move forward with the booking before the price goes up based on demand or other factors.

Alternatively, you can consider using other airline miles you have to book an alternative itinerary, or using cash so you can save your miles. That said, racking up miles you never use is not recommended since rewards currencies are devalued year after year. Airline miles are meant to "earn and burn," and there's little value in hoarding them unless you're saving up for a big trip.

American Airlines miles expire if you don't earn or redeem any of them over the course of 24 months. However, you can easily "restart the clock" if your miles are about to expire by redeeming some miles or earning miles with qualifying activity or purchases made on a co-branded airline credit card.

You can sign up free to become an American AAdvantage member on AA.com. You'll just need to share information like your name, address, email address, and phone number.

You cannot convert American miles to cash. However, you can redeem your miles for Admirals Club memberships, rental cars and hotel stays, vacation packages, luxury experiences, and donations to partner charities.

The information presented here is created by TIME Stamped and overseen by TIME editorial staff. To learn more, see our About Us page.