Democratic senators are calling on President Biden to expand the amount of student loan forgiveness available to parents who took out loans to pay for their children’s college tuition. But experts also want Congress to take action to prevent low-income parents from facing this financial burden in the future.

Both argue that borrowers who took out Parent PLUS loans—which are federal loans with higher interest rates and fees that parents can use to help their children pay for college—have been left behind in the push for debt relief. Those who take out Parent PLUS loans are disproportionately low-income Black and Latino families, and many struggle to pay off that debt decades after their child graduates.

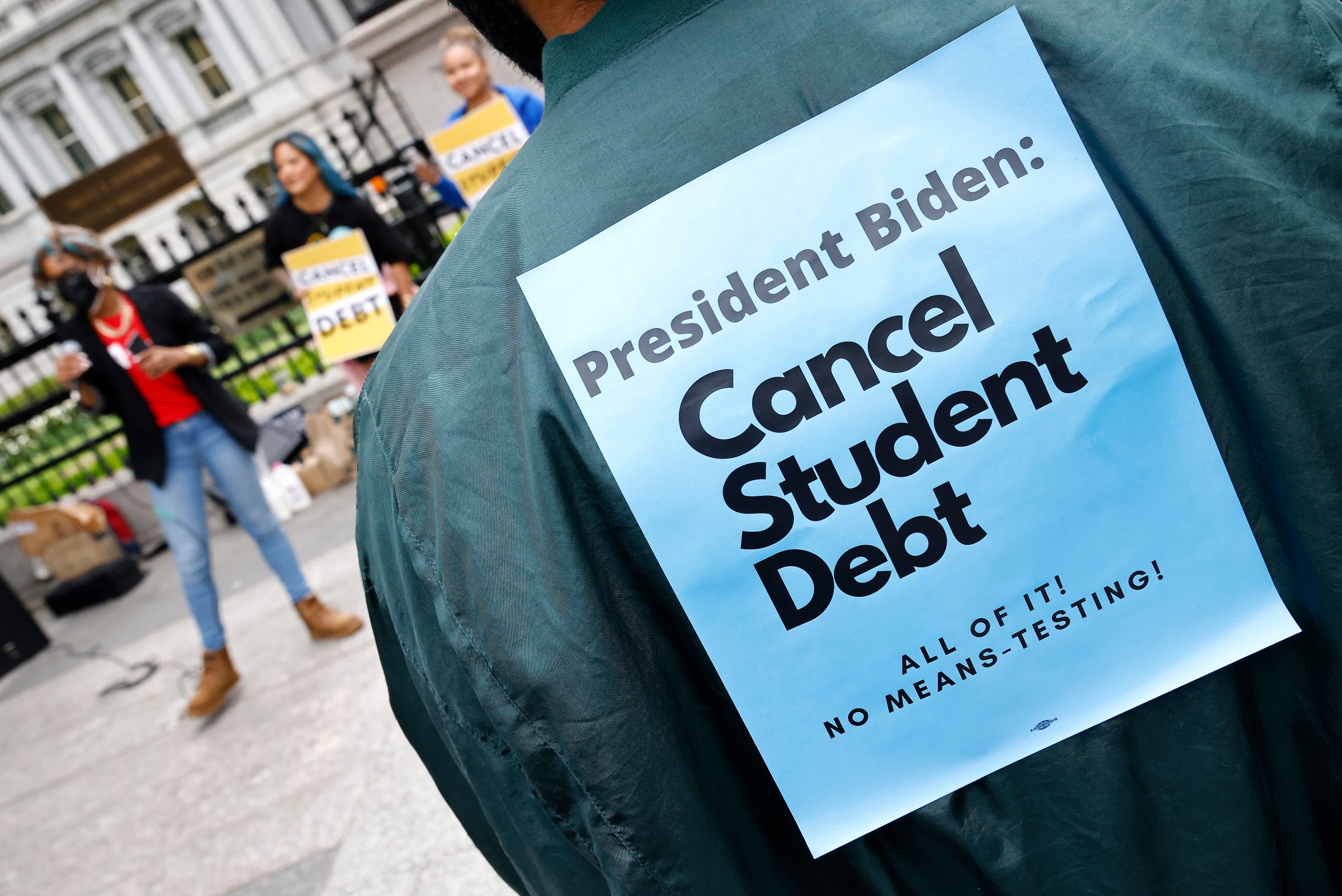

Under the Biden Administration’s student debt relief plan, people who make less than $125,000 per year will receive up to $10,000 in forgiveness — including parents who took out loans for their children’s education.

Borrowers who attended college with Pell Grants, designed to help low-income students, are eligible for up to $20,000 in forgiveness. But that does not apply to parents whose children received Pell Grants. Parents are only eligible for that additional relief if they were Pell Grant recipients, themselves.

In a letter to Biden on Monday, eight Democratic Senators, led by Maryland Sen. Chris Van Hollen, asked the administration to extend that additional $10,000 in forgiveness to Parent PLUS borrowers whose children were Pell Grant recipients, to include Parent PLUS borrowers in more lenient repayment plans based on income, and to allow parents to participate in the Public Service Loan Forgiveness program as long as their child has a job that meets the public-service qualifications.

“These borrowers demonstrated significant financial need at the time they borrowed the PLUS loan, as evidenced by the fact that their students qualified for Pell Grants based on family income,” they wrote in the letter to Biden. “Like student borrowers who received Pell Grants, these borrowers also face numerous barriers to successful repayment and should receive relief.”

More than 3.6 million Parent PLUS borrowers currently owe a collective $107 billion in student loans, which accounts for about 10% of all student loan debt in the U.S.

While the Parent PLUS program was initially aimed at middle-class families, most Parent PLUS recipients today also receive Pell Grants, making them one of the most low-income groups of students, according to a report published in May by the Century Foundation, a progressive think tank.

In 2018, 42% of Black Parent PLUS borrowers and 26% of Latino Parent PLUS borrowers were expected to contribute nothing towards a college education, meaning they were too poor to afford college costs out of pocket, based on U.S. Education Department calculations.

That, coupled with the loan’s high interest rates, helps explain why many Parent PLUS borrowers struggle to repay those loans, especially as some parents are working jobs without the income benefit of a degree.

Peter Granville, a senior policy associate at the Century Foundation who authored the May report, found that 28% of students who used a Pell Grant and a Parent PLUS loan to pay for college have parents who did not attend college — parents who would therefore not be eligible for the additional $10,000 in debt forgiveness under the Biden Administration’s plan.

The median Parent PLUS borrower owes $29,600 when their child graduates. But on average, those borrowers still owe 55% of their initial balance after 10 years and 38% after 20 years, according to the Century Foundation report.

Granville supports the changes that Van Hollen and other Senators called on Biden to make, but he would also like to see Congress take action to prevent Parent PLUS loans from burdening more families moving forward.

“The ball is really in Congress’s court to change the underlying factors that lead to Parent PLUS being such a burden for some families,” Granville says. “We need sufficient grant aid, so that low-income families don’t have to take out these loans in the first place. Only Congress can do that on a national scale.”

He would like Congress to invest in endowments at historically Black colleges and universities, where the use of Parent PLUS loans is greatest; expand the Pell Grant; and work to make college more affordable overall, so families won’t need to rely heavily on Parent PLUS loans and other student loans in the future.

“How are they going to reduce the cost of college that parents face? Will they make the terms of Parent PLUS loans more friendly for parents?” he says. “Once cancellation has been done, we need to keep the pressure on Congress to take action for future student loan borrowers.”

More Must-Reads From TIME

- The 100 Most Influential People of 2024

- The Revolution of Yulia Navalnaya

- 6 Compliments That Land Every Time

- What's the Deal With the Bitcoin Halving?

- If You're Dating Right Now , You're Brave: Column

- The AI That Could Heal a Divided Internet

- Fallout Is a Brilliant Model for the Future of Video Game Adaptations

- Want Weekly Recs on What to Watch, Read, and More? Sign Up for Worth Your Time

Write to Katie Reilly at Katie.Reilly@time.com