After the harsh morning sunlight, the research center was dark and cool inside. There, in front of a large monitor, an engineer clicked on a slide to begin the day’s presentation for his visitor: “Towards carbon emissions net zero,” it read.

This was not, as the slide suggested, an environmental organization or a climate conference. TIME had been allowed inside the normally secretive R&D hub of Saudi Aramco, a fossil-fuel behemoth that dwarfs giants like ExxonMobil and Chevron. Even as the world’s largest oil exporter busily pumps crude and pours it into the hulls of seafaring tankers, it is loudly proclaiming its ambitions to reach net-zero carbon emissions within its borders by 2060.

For Saudis—two-thirds of whom are younger than 35—climate change is not a far-off issue. Summer heat regularly tops 120°F. Climate scientists last year said they believed the Middle East’s temperatures could become “potentially life-threatening for humans” in the years ahead. “These countries are already facing a crisis,” says Ali al-Saffar, an analyst on the region at the International Energy Agency in Paris. “They have skin in the game.”

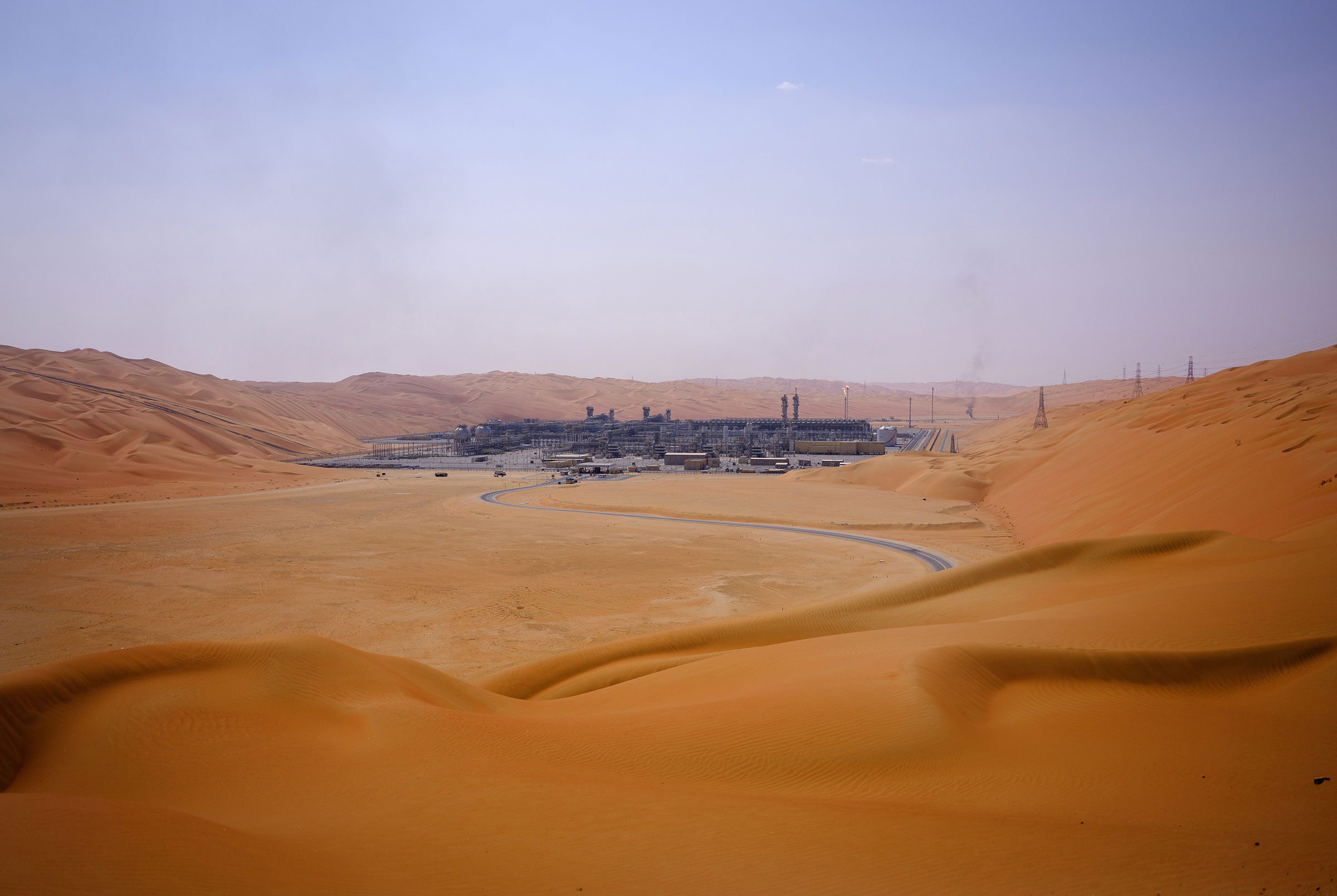

The Saudis are hardly blameless for global warming; environmentalists say Saudi Aramco has generated more than 4% of global greenhouse gases since 1965. Here on the edge of the Arabian Desert, Saudi Arabia has tapped an unfathomable quantity of oil—about 267 billion barrels of proven oil reserves, or about 15% of the world’s total—since the 1930s, when California wildcatters struck a gusher and turned a tribal kingdom into a global oil power.

More than 80 years on, Saudi Arabia’s domination in the oil world has scarcely diminished. It pumps nearly 11 million barrels of oil a day—about 1 in every 10 in the world—and sells more than 7 million of those on international markets, earning vast riches for the ruling royals and their state-owned company Aramco, whose profits rocketed to about $110 billion last year.

And yet, after years of lucrative production, a global crisis now hangs over the Saudis’ prized position. Almost all countries have committed to cutting their use of fossil fuels, by far the biggest source of the planet’s greenhouse gases. That could entail the most dramatic shift in energy since the car age began more than a century ago. For Saudi Arabia, the question is whether it can remain a super-power in the oil world and at the same time join the global climate fight—or whether its ability to diversify its economy away from an overwhelming dependence on oil will come too late, fall short, or otherwise prove itself to be, as some charge, lip service to its critics.

If Saudi Arabia’s gamble pays off, it could emerge from the global energy transition as the world’s indispensable fossil-fuel power—while ironically boasting of a clean-energy, eco-friendly country at home. “They like to have their cake and eat it,” says Jim Krane, energy geopolitics expert at Rice University in Houston. “The Saudis’ ambition is to be the last man standing in the global oil market. They want the last drop of oil drilled to come from a Saudi field.”

The country has ample money for its grandiose plan. Aramco is now the second most valuable company in the world (behind Apple), with a market cap of more than $2.3 trillion. With sharp price increases at the gas pumps, its earnings have nearly doubled this year. The vast oil riches have given the kingdom of just 35 million people enough clout to effectively dictate quotas within OPEC, the international cartel of 13 major oil-producing countries, with the potential to impact stock markets across the world.

That unique position could last for decades, especially since the country’s de facto leader, Crown Prince Mohammed bin Salman, or MBS, is just 37 years old, and could rule for generations.

“The demand for oil will continue growing,” Saudi Energy Minister Prince Abdulaziz bin Salman—the far older half-brother of MBS—tells TIME over tea in his office in Riyadh. “At what level, I don’t know,” he says. “Anyone who tells you that they have a good grasp of when and where and how much is certainly living in a fantasyland.”

Last February, MBS transferred $80 billion from the oil company to the country’s sovereign wealth fund, the Public Investment Fund, or PIF, which he chairs. The fund’s assets have risen sharply since the pandemic hit, to about $620 billion, since it bought into the lockdown dip to invest billions in Netflix, Carnival Cruises, Marriott hotels, California’s EV automaker Lucid Motors, and other stocks, when they were pummeled by global lockdowns.

Those assets could help fund Saudi Arabia’s own energy transition. Just how that unfolds—how carbon emissions are “handled,” as Abdulaziz puts it—is what occupies numerous top government engineers across the country. The efforts have drawn some interest from Western investors, whose unease with the kingdom’s human-rights abuses has collided with business exigencies.

On the edge of Riyadh one crisp winter morning, in Saudi Arabia’s King Abdullah Petroleum Studies and Research Center, known by its acronym KAPSARC, about 15 specialists gathered to outline the strategy for TIME. Abdulaziz calls the researchers “my young cadets, none over 30.” Many of them are women, and many are U.S.-educated.

Among the plans is a network of EV charging stations, and a project to upgrade offices and homes with low-energy electricity systems—about 33 solar and wind projects are in construction. Funding all this, they say, is no problem, if authorized by the royals. “We have a mandate from the King to make all buildings retrofitted for energy efficiency,” says Mudhyan al-Mudhyan, of the National Energy Services Company. “We have our own capital to finance all our projects, so we don’t need to go to banks or any lending institutions.”

Perhaps the biggest experiment under way is located in NEOM, a futuristic $500 billion city being built from scratch in the northwest of the country. In theory, it will become the testing ground for concepts like air taxis and so-called green hydrogen, created by using renewable energy, and which MBS has boasted will generate most of NEOM’s electricity. A green-fuel plant is being built in NEOM, at a cost of $5 billion. “It is a clear path towards moving from the lab to the research center, to fully deployed technology,” says Sadad al-Husseini, a geologist who previously headed Aramco’s exploration and production department and who now heads Husseini Energy Co., a forecasting and analysis consultancy in Aramco’s hometown of Dhahran. Aramco’s research includes trying to capture and reuse the carbon spewed into the atmosphere from Saudi oil fields. It’s a tactic Saudi Arabia is relying on heavily to meet its emissions targets. Although its effectiveness is still deeply uncertain, the Saudis have begun capturing carbon, shipping it from a gas field in the desert to a plant 52 miles away, to be turned into petrochemicals.

Engineers are also researching a way to transport “blue” hydrogen—derived from natural gas—to far-off Europe and Asia. Saudi Arabia -delivered the first shipment of blue ammonia to Japan in 2020, for use in generating electricity, and has signed an agreement with Germany to develop green hydrogen. Aramco is also working on creating a synthetic fuel from a mix of captured carbon and hydrogen, which it claims will cut the pollution from regular cars by 80%. The company says it plans to start marketing it in 2025.

The fact that Saudi Arabia has only one oil company, and that it’s owned by the state, enables it to spend freely on research. “You won’t find Exxon or Chevron or any of these companies focusing research on things like this,” Husseini says. “If you say, ‘Do a research project that won’t pay out for 20 years,’ they would say, ‘That’s not our job.’”

With an open spigot of cash to spend, the engineers foresee creating new exports for the country, particularly of hydrogen. “We can develop world-class engineering companies to design hydro-carbon resources or plants in the kingdom, and also do that service for anyone else who’s interested,” says Yehia Khoja, an electrical engineer trained at Stanford University, who is an adviser to the Energy Ministry. In a green Saudi Arabia, he says, the country would cut its own fossil-fuel consumption by about 1 million barrels a day. It could then sell that oil on world markets, and earn nearly $100 million a day, at current prices. “It is how we justify the economics of this project,” Khoja says. He calls the country’s plan “holistic and inclusive of all solutions. It is our way of trailblazing a path towards a solution, rather than just being content in being part of a solution,” he says.

Climate scientists reject that argument, accusing Saudi Arabia of greenwashing by declaring its commitment to carbon reductions while aiming to increase oil production to 13 million barrels a day. Aramco’s carbon reduction does not include so-called Scope 3 emissions generated by oil consumption, which scientists believe account for most fossil-fuel greenhouse gases. “Aramco’s approach to achieving emissions reductions lacks credibility,” Carbon Tracker Initiative, a financial think tank based in London and New York City, said in a July report. That is not just a problem for the planet. Oil-loving Saudi Arabia could also one day face falling revenues from its energy company as the world shifts to renewable energy. “Saudi Aramco is exacerbating, not mitigating, its exposure to transition risk,” the report says.

Until recently, it would have been unimaginable that Saudi Arabia could be seen as a trailblazer in any global investments, let alone climate mitigation—and indeed, many doubt it ever will be. Foreign investment plunged after the October 2018 murder of Jamal Khashoggi, a Saudi journalist living in Washington, who was killed and dismembered by Saudi operatives in the country’s consulate in Istanbul, his remains never recovered.

Last year, the CIA concluded that MBS had surely approved the capture or murder of Khashoggi, given his “absolute control” over Saudi security services. Amid the global outrage over the grisly assassination, CEOs and Western officials boycotted that year’s Future Investment Initiative, MBS’s flagship Davos-like gathering in Riyadh.

And yet, three years after Khashoggi’s death, foreign investors were back in Saudi Arabia in force, packing MBS’s Saudi Green Initiative conference last October, and drawn to the plethora of potential deals in one of the biggest energy plans anywhere. As war raged in Ukraine, Saudi officials invited top Wall Street investors to a New York City road show in early April, to pitch their new city NEOM—a key element of the country’s green plans.

For both investors and politicians, there’s a growing acceptance that the prince’s tenure is likely to outlast almost every world leader—one reason President Biden finally visited Riyadh in July, even giving him a cozy fist bump. “The idea you’re going to get rid of MBS and replace him with the Canadian Parliament is naive in the extreme,” says David Rundell, a former longtime U.S. diplomat in Riyadh and author of a book on the crown prince. “The alternative is al-Qaeda.”

There is palpable relief on the ground that Khashoggi’s death has had little lasting business impact. “I think you could say we have moved on,” says Husseini, the longtime Aramco executive. “People may have postured and said, ‘Oh, I will never go there,’” he says. “But there are fundamentals in the world. You have to maintain the economy moving.”

That seems clear from the Saudi stock exchange, known as the Tadawul, which is owned by the government through its sovereign wealth fund. Its CEO, Khalid al-Hussan, estimates that about 14% of stocks are held by non-Saudis, who purchase shares through about 2,600 institutional investors trading on the exchange. When the Tadawul went partly public last December, it was bombarded with requests for shares from foreign investors, with subscriptions reaching 10 times the amount on offer, according to Hussan. “I have met with more than 100 international investors,” he tells me on the day the applications closed.

But for Saudis to keep attracting new investors, they will increasingly need companies that (at least on paper) are committed to tackling climate change. “We see this pressure in the U.S. and Europe more and more in the future,” Hussan says. Environmental issues, he says, “will drive their investment decisions.”

Inside Aramco’s R&D complex in Dhahran, there is a strong belief that despite the climate crisis, it will not only remain a huge oil giant but increase in size. Aramco’s engineers argue that the energy transition should focus on how to drill oil more cleanly, rather than cutting the amount of oil pumped.

The company’s researchers say they are already working with automakers (which they declined to name) to switch to hydrogen-powered engines; a Nissan sedan fitted with a green-hydrogen engine sits parked outside the front door as an example. A short drive away is the company’s new center for artificial intelligence, dubbed the 4IR (fourth industrial revolution) building. One display shows mangrove plantations Aramco has planted near its huge Ras Tanura refinery on the Arabian Gulf; vegetation acts as a natural system of carbon capture, extracting emissions from the air and absorbing them in the swampy ground.

But the heart of the 4IR building is a large circular control room resembling NASA’s ground control in Houston. There, engineers monitor every drop of oil Aramco pumps across hundreds of oil fields, with 60 drones and a fleet of robots sucking up 5 billion data points in real time. A screen wraps around the walls, showing a blizzard of graphs and figures—information engineers say they can use to analyze how to keep producing oil while cutting emissions. “It is all about efficiency and sustainability,” one says, guiding me through the center.

To environmentalists, Aramco’s efforts seem like the last gasp of an oil giant attempting to keep the global climate campaign at bay. “Aramco has no plans to reduce oil and gas production by 2030,” says ClientEarth, an international environmental legal organization. The government, it says, “has a long history of fighting efforts to tackle climate change.”

Energy analysts say the Saudis—who since the 1930s have drilled oil more cheaply than anyone else—are well positioned to find solutions to the climate crisis, and put them into effect. “They have built a lot of know-how and a lot of capacity. They have the pipeline infrastructure, the ports infrastructure,” says Saffar of the International Energy Agency. The country now needs to end its overwhelming dependence on oil revenues and transition to more clean energy—a tough two-headed challenge, Saffar says. “If you could make them work in the same direction, you would be really onto something,” he says. The question is whether Saudi Arabia’s rulers have the will to do so, even at the risk of their outsize profits. —With reporting by Solcyre Burga, Leslie Dickstein, and Anisha Kohli/New York

More Must-Reads from TIME

- How Donald Trump Won

- The Best Inventions of 2024

- Why Sleep Is the Key to Living Longer

- How to Break 8 Toxic Communication Habits

- Nicola Coughlan Bet on Herself—And Won

- What It’s Like to Have Long COVID As a Kid

- 22 Essential Works of Indigenous Cinema

- Meet TIME's Newest Class of Next Generation Leaders

Contact us at letters@time.com