It’s been a difficult year for shoppers looking for cars, electronics and anything that requires a computer chip. A global semiconductor shortage has left many companies unable to fill orders or even finish products they’ve started assembling, clogging up warehouses and leaving a lack of inventory across the nation.

Buying a new PlayStation 5 console remains nearly impossible. Several automakers have slowed down production in their factories, delaying shipments of new vehicles. It’s even impacted more obscure products—just try to find an affordable dog washing booth these days. More than two years after the pandemic began to shock the global semiconductor supply chain, the companies that make the chips to power these products are still feeling the pinch.

Washington’s solution

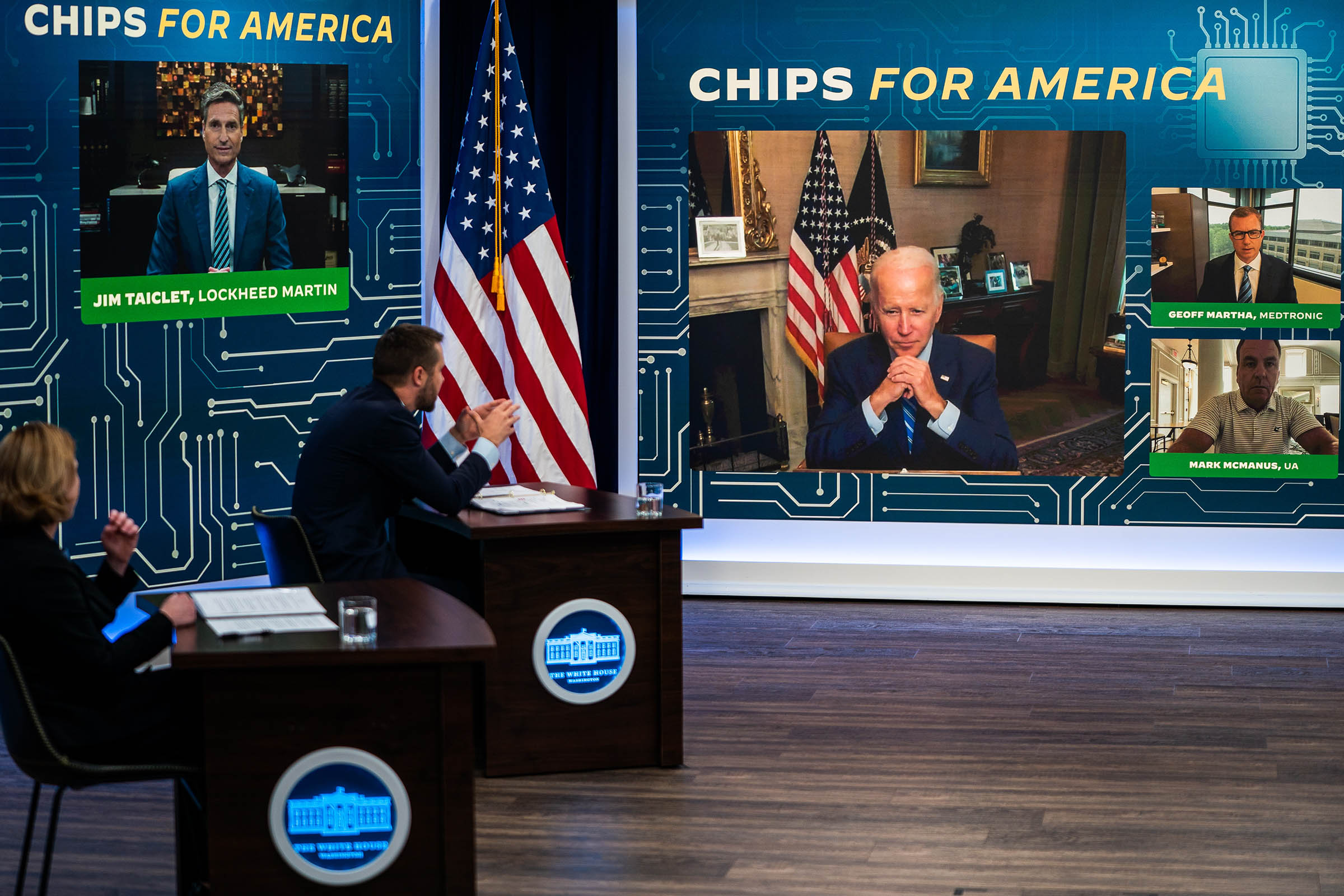

The Senate could provide some relief in the coming year, as it votes on a $52 billion package this week that would provide funding and tax credits to companies that produce chips and invest in domestic manufacturing. If it passes the Senate as expected, the House will consider the legislation before its August recess, which begins in two weeks.

“We are overly dependent on other countries for chips,” Commerce Secretary Gina Raimondo told TIME on Tuesday while the Senate voted to limit debate on the spending package. “Chips are the most essential item in modern industrial equipment, medical technology and every piece of military equipment.”

The burst in federal spending is intended to spur growth in domestic chip production, according to supporters of the bill, but it may take years for consumers to see the effects when shopping for new electronics.

For many of the largest tech and automotive companies, semiconductors used to be a relatively inexpensive component, one that cost as little as two cents to manufacture in the 1970s. Now, these tiny electronic switches are the biggest obstacle preventing more sales.

An iPhone 13, for example, requires approximately 60 semiconductors. The PlayStation 5 requires about 130. Javelin missile systems have about 200 chips and sophisticated defense helicopters have over 2,000. For automobiles, the issue is even more extreme. The Porsche Taycan has about 8,000 chips inside. And although the global microchip crunch may be waning after two years, tech companies and automakers are striving to gain greater control over their supply of chips and raw materials.

Read more: Intel Reveals Plans for Massive New Ohio Factory, Fighting the Chip Shortage Stateside

The deeper problem

But with chips in the spotlight, many in the industry are warning lawmakers that the ongoing chip shortage can’t be solved by a sudden surge in government funding.

“It’s not really just a semiconductor chip shortage. That’s the end product,” says Michael Hochberg, the president of Luminous Computing, a California-based chip startup that develops light-based semiconductors for artificial intelligence. “It’s a semiconductor talent shortage, a semiconductor equipment shortage, and a semiconductor fabrication capacity shortage, too. It’s all of those things at once.”

Every chip needs to be embedded in one of those ubiquitous green printed circuit boards in order to work, similar to how a brain needs a body, says Travis Kelly, CEO of the Arizona-based Isola Group and chairman of the Printed Circuit Board Association of America. These circuit boards require laminate, copper foil and fiberglass yarn, among other raw materials that are in short supply.

“It used to be that semiconductor manufacturers could just assume that they would get these parts out of a catalog by FedEx and not worry about it,” Hochberg says. “It was like breathing the air outside. They didn’t worry about the availability of parts until about two years ago.”

“Unless we address the entire microelectronics ecosystem, we’re not truly securing our domestic supply chain,” Kelly says.

The national security concerns

Kelly’s printed circuit board firm, Isola, is among the last American firms to manufacture printed circuit board laminate in the U.S. The materials needed to make that laminate—fiberglass yarn and copper foil in particular—are only made and sold by one supplier in the entire country. “It’s a single point of failure,” Kelly says. “Think about that for defense.”

Lawmakers and those involved in the supply chain are now ringing the alarm about the lack of American-made semiconductor materials. Two decades ago, the U.S. produced over 26% of the world’s printed circuit boards. That number is now down to 4% as more firms take advantage of the tax breaks and lower labor costs of operating overseas. China and Taiwan in particular have become hotbeds for semiconductor and printed circuit board factories, with their governments investing heavily in chip production and building onshore sources for the chemicals and tools needed to support an independent industry.

“There’s no more important strategic good than semiconductors,” Hochberg says, listing off examples that range from national security to artificial intelligence. “If we want to maintain a technical and strategic advantage for AI, information warfare and military systems, when these chips are at the heart of these systems, it’s going to be necessary to get ahead of this problem.”

The national security concerns of producing semiconductors abroad has been a crucial aspect of getting Congress to take action on the CHIPS Act, a senior legislative advisor to Raimondo told TIME.

“People may not care where the printed circuit board comes from when they’re operating a toaster, but they do care about it for warfighters and military applications,” Isola’s Kelly says.

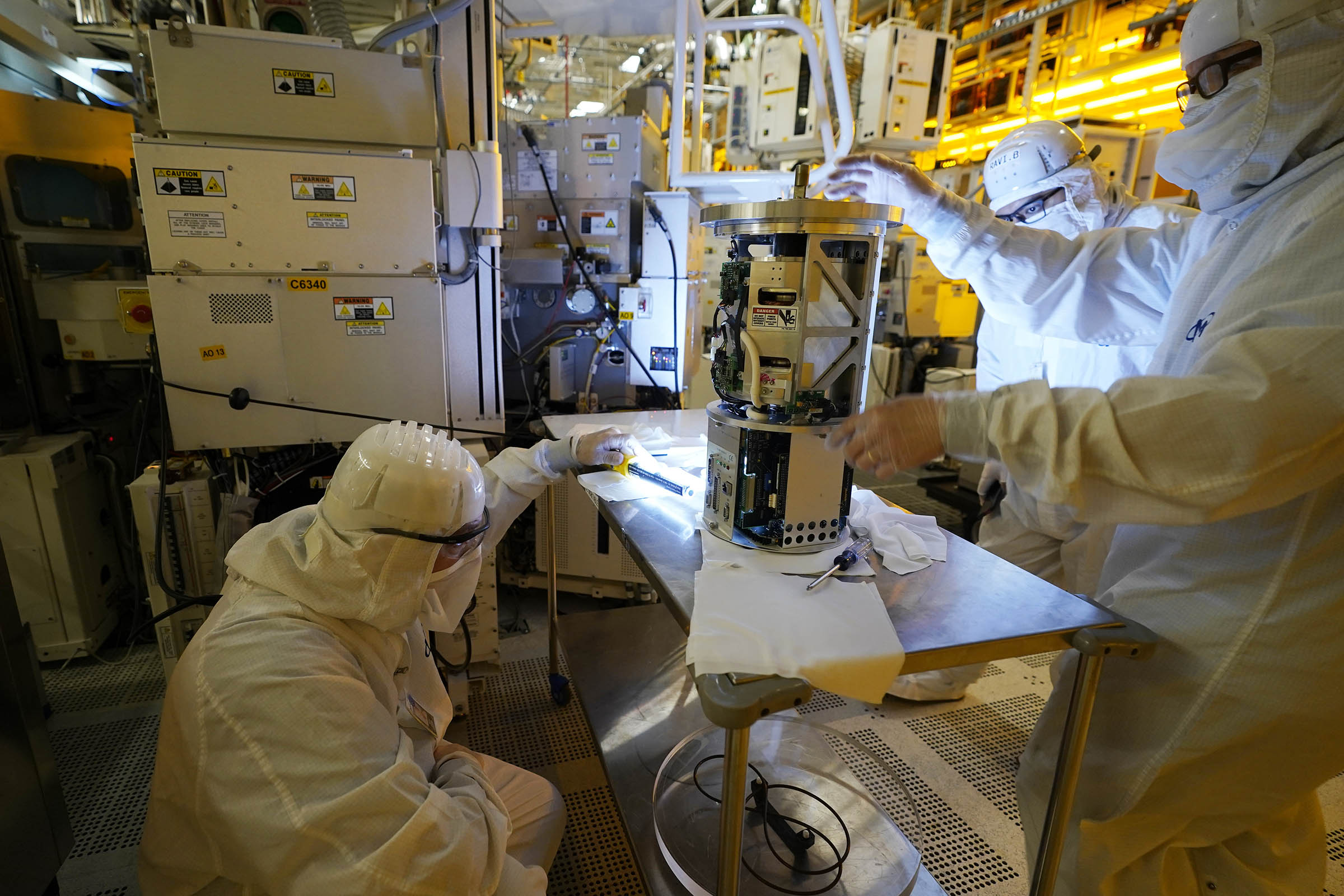

Only a handful of advanced semiconductor factories, also called fabs, remain in the U.S. today. Building new factories can cost between $10 to $20 billion and take up to five years to build given the complex equipment and chemicals needed to run a factory. And the process of actually transforming all of those materials into a final chip takes nearly three months alone.

“It’s everything from silicon wafers, substrate, chemicals,” Raimondo says. “This stuff is not made in the United States, and it’s shocking.” Congress is hoping that the suppliers of all these parts will be incentivized to relocate to the U.S. once more fabs are built domestically—a primary goal of the CHIPS Act. “If TSMC builds a mega fab in Arizona, or if Intel builds a mega fab in Ohio, the whole ecosystem of talents and suppliers will develop [there],” Raimondo explains.

What’s next

Some executives see the semiconductor shortage easing as suppliers stock up on chips and other components. Taiwanese chipmaker TSMC, the world’s largest contract manufacturer, warned of “excessive inventory” in the semiconductor supply chain that will take the rest of the year and beyond to rebalance. Not all semiconductor foundries have had the same fortune, but it’s a positive sign for the tech and automotive industries that depend on these chips.

Korean automaker Hyundai recently posted its best quarterly profit in eight years, and Swiss engineering company ABB, which relies on semiconductors to build industrial technology products, said it’s finally seeing relief in the supply chain after years of challenges. “We have now come to a situation where we have much better commitments from the suppliers,” ABB Chief Executive Bjorn Rosengren said in a July 21 earnings call.

And the White House and Department of Commerce are optimistic that companies will begin to announce investments in the U.S. chips industry if the CHIPS Act funding is signed into law.

“It’s not very different from what you’re seeing in Germany and Italy, which have allowed themselves to become overly dependent on Russian oil and gas,” Raimondo says. “That could be the United States if we don’t take action now.”

More Must-Reads From TIME

- The 100 Most Influential People of 2024

- The Revolution of Yulia Navalnaya

- 6 Compliments That Land Every Time

- Stop Looking for Your Forever Home

- If You're Dating Right Now , You're Brave: Column

- The AI That Could Heal a Divided Internet

- Fallout Is a Brilliant Model for the Future of Video Game Adaptations

- Want Weekly Recs on What to Watch, Read, and More? Sign Up for Worth Your Time

Write to Nik Popli at nik.popli@time.com